Derbit’s Asia Expansion: A New Era for Crypto Derivatives

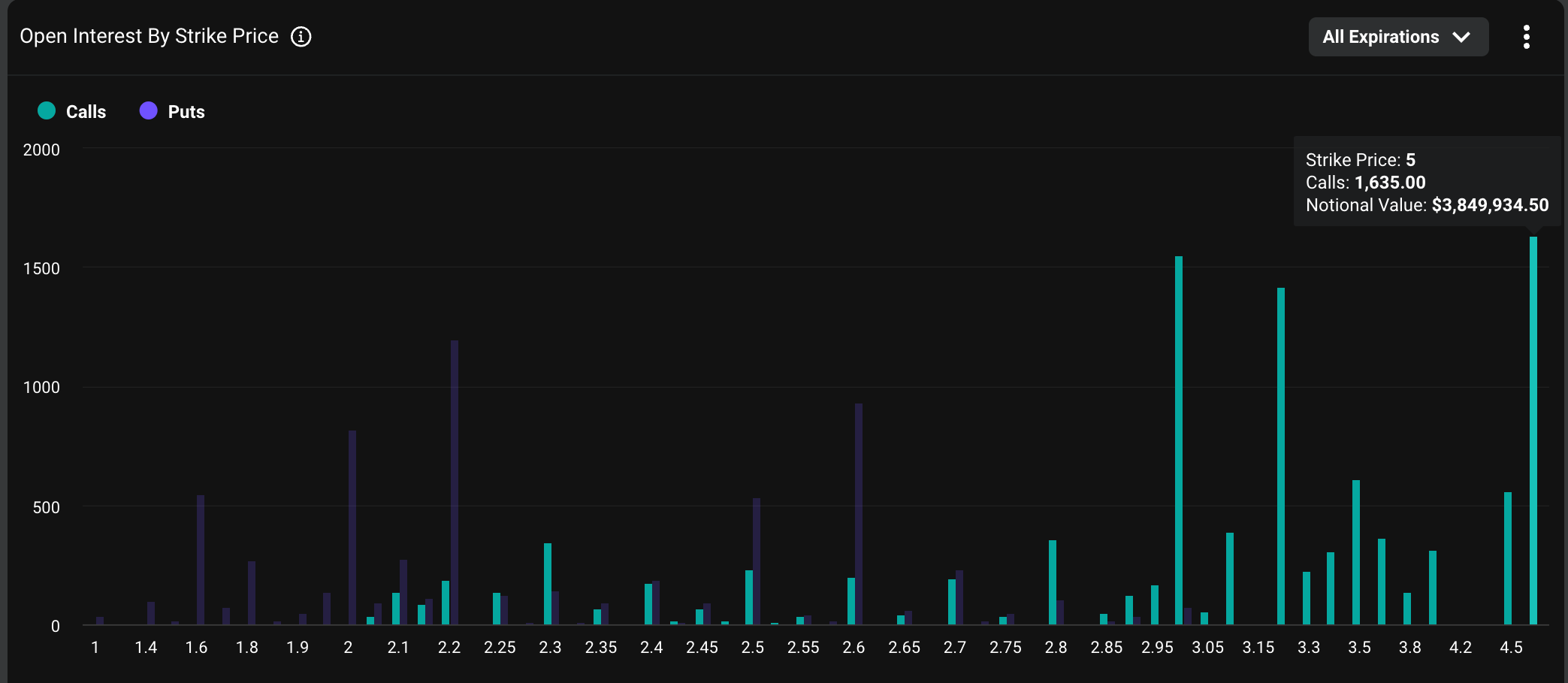

In a recent interview, Deribit’s Asia business development head revealed that most of the exchange’s business comes from covered calls. This revelation sheds light on Deribit’s strategic focus and its potential impact on the crypto derivatives market.

What are Covered Calls?

A covered call is an options trading strategy where an investor owns the underlying asset and sells a call option on that asset. The seller receives a premium for selling the call option, which generates income. In exchange, the seller grants the buyer of the call option the right to buy the underlying asset from them at a specified price (strike price) before a specific date (expiration date).

Deribit’s Focus on Covered Calls

Deribit’s business development head explained that covered calls account for a significant portion of the exchange’s trading volume. This strategy is popular among traders seeking to generate income through options trading. By focusing on covered calls, Deribit aims to cater to this demand and attract more traders to its platform.

Impact on Individual Traders

For individual traders, Deribit’s emphasis on covered calls presents an opportunity to explore a new trading strategy. Covered calls can be a profitable way to generate income, especially in volatile markets. Traders can sell call options on cryptocurrencies they already own, thereby reducing their overall cost basis and generating income.

- Reduced cost basis: Selling a call option on a cryptocurrency you already own effectively lowers your overall cost basis, as the premium you receive is a credit to your account.

- Income generation: Covered calls can generate regular income, especially in volatile markets where option premiums can be high.

- Limited risk: The potential loss from selling a covered call is limited to the difference between the strike price and the price at which the trader bought the underlying asset.

Impact on the World

Deribit’s focus on covered calls could lead to increased adoption of options trading strategies in the crypto market. As more traders become familiar with these strategies, we may see a shift away from simple spot trading towards more complex derivatives trading.

Additionally, the popularity of covered calls could attract more institutional investors to the crypto market. Institutions have traditionally used covered call strategies to generate income and hedge risk in their portfolios. With the growing acceptance of cryptocurrencies as a legitimate asset class, it’s likely that we’ll see more institutional adoption of crypto derivatives, including covered calls.

Conclusion

Deribit’s focus on covered calls is a strategic move that caters to the demand for income-generating options trading strategies in the crypto market. For individual traders, this presents an opportunity to explore a new way to generate income and reduce the cost basis of their cryptocurrency holdings. For the world, it could lead to increased adoption of options trading strategies and the attraction of more institutional investors to the crypto market.

As the crypto market continues to evolve, it’s essential for traders to stay informed about the latest trends and strategies. Deribit’s emphasis on covered calls is a significant development in the crypto derivatives space, and traders should consider adding this strategy to their toolkit.