Analyzing the Bearish Breakout of $BNB: A Technical Perspective

The cryptocurrency market has been experiencing a turbulent ride over the past few months, with many coins and tokens showing bearish trends. Among them, Binance Coin ($BNB) has displayed a significant downturn since February 14, 2023. In this article, we will delve deeper into the technical analysis of the 4-hour chart of $BNB and discuss the implications of this bearish breakout.

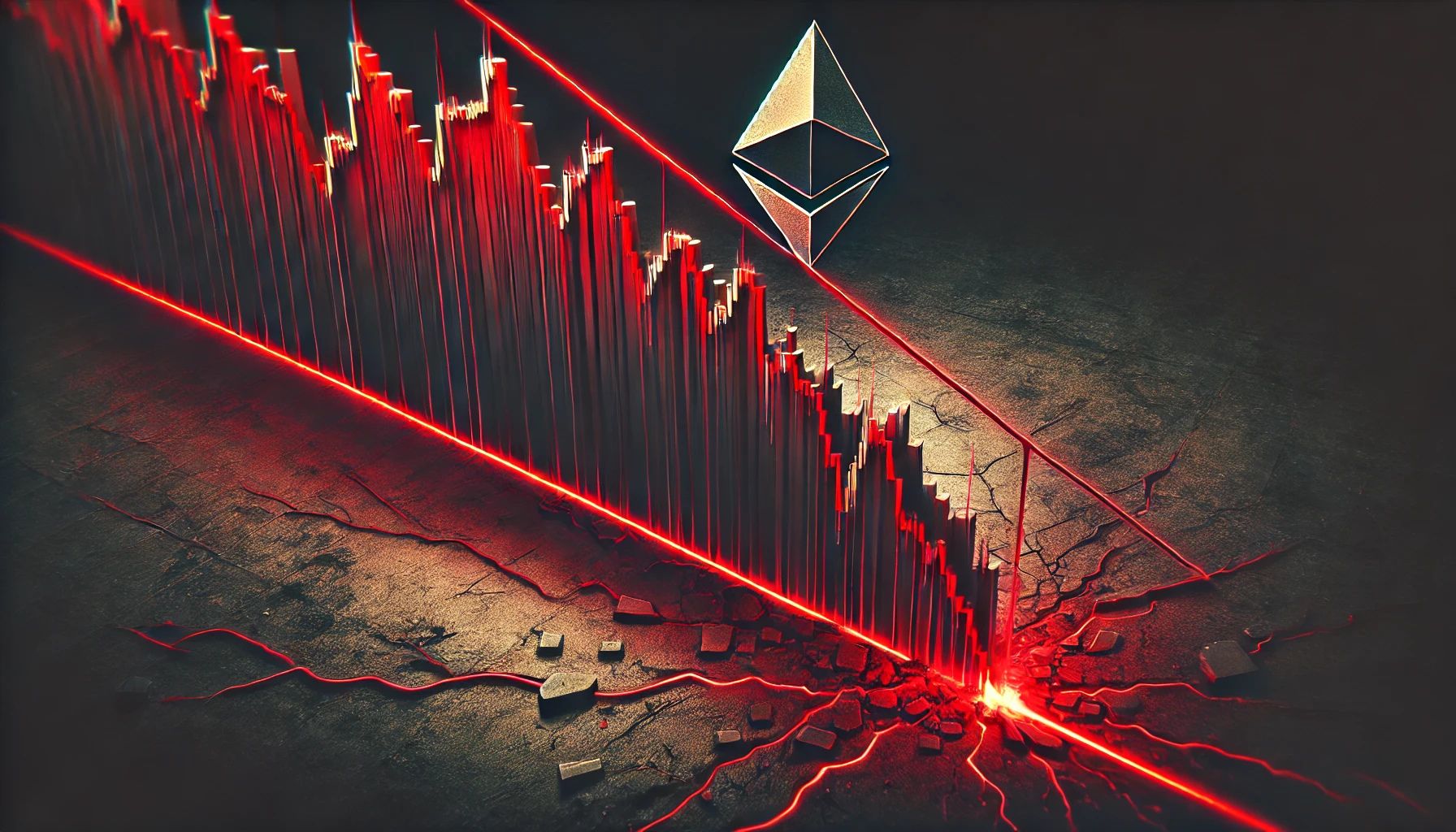

Bearish Breakout from a Triangular Pattern

The 4-hour chart of $BNB reveals a bearish breakout from a triangular pattern, which often signifies a continuation of the ongoing downtrend. This pattern, also known as a symmetrical triangle, is formed when the price ranges between two converging trendlines. Typically, a breakout occurs when the price breaks through the resistance line, indicating a potential decline in price.

Technical Indicators: EWO and RSI

Two popular technical indicators, the Ellicott Wave Oscillator (EWO) and Relative Strength Index (RSI), further support the bearish outlook for $BNB. The EWO, which is used to identify the Elliott Wave cycles, displays convergence, suggesting that the current correction is nearing completion. Meanwhile, the RSI, which measures the strength of a security’s recent price action, also indicates that the coin is oversold and that a potential decline could be on the horizon.

MACD Signals a Bearish Crossover

Another technical indicator, the Moving Average Convergence Divergence (MACD), further reinforces the bearish sentiment. The MACD, which is calculated by subtracting the 26-day Exponential Moving Average (EMA) from the 12-day EMA, has undergone a bearish crossover. This occurs when the shorter-term EMA crosses below the longer-term EMA, indicating that the trend is shifting from bullish to bearish.

Decreased Volume

The volume trend also adds credence to the bearish outlook for $BNB. The volume has been decreasing during the recent correction, which is often a sign of a correction or a potential trend reversal. A decline in volume can indicate that sellers are more eager to sell than buyers are to buy, leading to a potential downtrend.

Implications for Individual Investors

For individual investors holding $BNB, this bearish breakout could mean a potential loss in value. It is essential to closely monitor the price action of $BNB and consider taking profit or implementing stop-loss orders to mitigate potential losses. Additionally, it may be prudent to consider diversifying your portfolio to minimize risk.

Global Impact

The bearish breakout of $BNB could have far-reaching implications for the broader cryptocurrency market. As Binance is one of the largest cryptocurrency exchanges by trading volume, the decline in $BNB could lead to a domino effect, causing other coins and tokens to follow suit. It is crucial for investors to stay informed about the market trends and adjust their investment strategies accordingly.

Conclusion

In conclusion, the 4-hour chart of $BNB indicates a bearish breakout from a triangular pattern, as evidenced by the EWO, RSI, and MACD. The decreasing volume further reinforces the idea of a correction or potential trend reversal. Individual investors holding $BNB may experience a potential loss in value, while the global impact could be far-reaching. It is essential to stay informed and adapt investment strategies accordingly.

- Bearish breakout from a triangular pattern

- Convergence of technical indicators: EWO and RSI

- Bearish crossover of MACD

- Decreasing volume

- Potential loss for individual investors

- Far-reaching implications for the broader cryptocurrency market