Bitcoin Miners Reduce Selling Activity, Holding $62 Million Worth of Bitcoin

Background

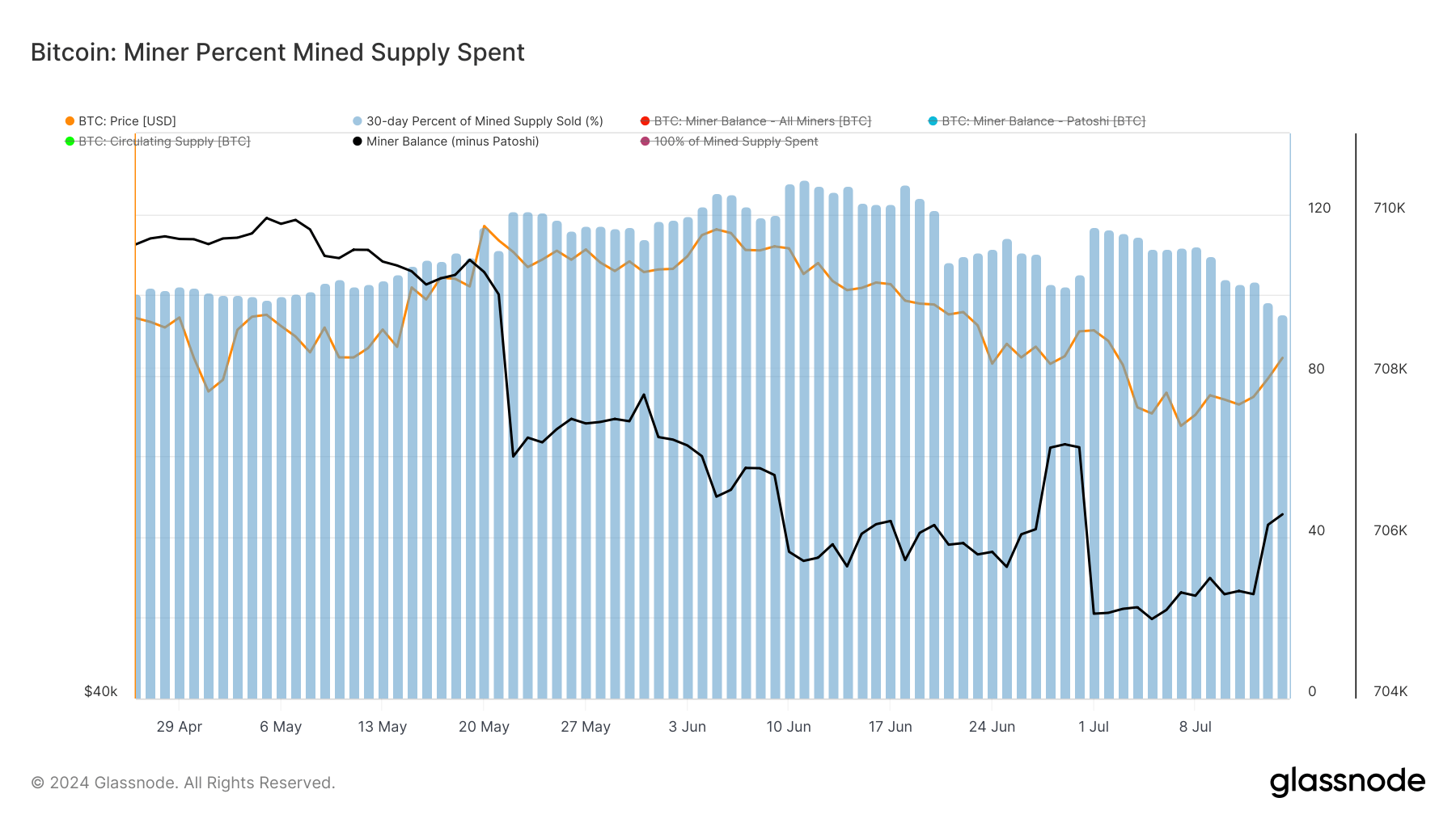

Since the post-April 2024 halving, Bitcoin miners have been adjusting their strategies to cope with reduced rewards. Initially, miners increased their selling activity to cover operational costs after their rewards were halved. However, recent data shows a shift in this trend, with miners now holding onto more of their Bitcoin as the price surpasses $62,000.

Current Situation

The latest chart from Glassnode reveals a significant decrease in the 30-day percent of mined supply sold. This decrease coincides with the rise in Bitcoin price and indicates that miners are less inclined to sell their newly mined coins. As a result, there is now approximately $62 million worth of Bitcoin held in reserves by miners.

Impact on Individuals

For individual Bitcoin investors, the reduction in miner selling activity could lead to increased scarcity of Bitcoin in the market. This scarcity may drive up the price of Bitcoin in the long run, potentially resulting in higher returns for those holding onto the cryptocurrency.

Global Implications

On a global scale, the decrease in miner selling activity could impact the overall supply and demand dynamics of Bitcoin. With miners hoarding more of their Bitcoin, there may be less new supply entering the market, leading to a potential supply shortage. This could have far-reaching consequences for the cryptocurrency ecosystem and its underlying technology.

Conclusion

Overall, the recent slowdown in miner selling activity and the increase in reserves held by miners signal a shift in the Bitcoin market dynamics. As the price of Bitcoin continues to rise, it will be interesting to see how miners adapt their strategies and how this will impact both individual investors and the global cryptocurrency landscape.