Nvidia’s Fourth-Quarter Earnings Report: A New Reality for Investors

All eyes were once again on Nvidia (NVDA) as the tech giant reported its fourth-quarter earnings last week. However, the excitement and anticipation that surrounded Nvidia just a year or two ago have faded. Gone are the days of skyrocketing growth and seemingly endless opportunities in artificial intelligence (AI) that delighted investors.

A Changing Landscape for Nvidia

The tech industry is a dynamic and ever-evolving landscape. Companies that were once at the forefront of innovation can find themselves facing new challenges and competition. Such is the case with Nvidia.

Despite reporting better-than-expected earnings for the fourth quarter, Nvidia’s stock price took a hit. The company’s revenue growth slowed down, and its earnings per share missed analysts’ estimates. The culprits? A slowdown in the demand for data center chips and a shift in the gaming market.

Impact on the Individual Investor

As an individual investor, the slowdown in Nvidia’s growth may mean a few things for you. First, it may be a good time to reevaluate your investment strategy. If you have a significant position in Nvidia, you may want to consider diversifying your portfolio. Diversification can help mitigate risk and potentially provide better returns over the long term.

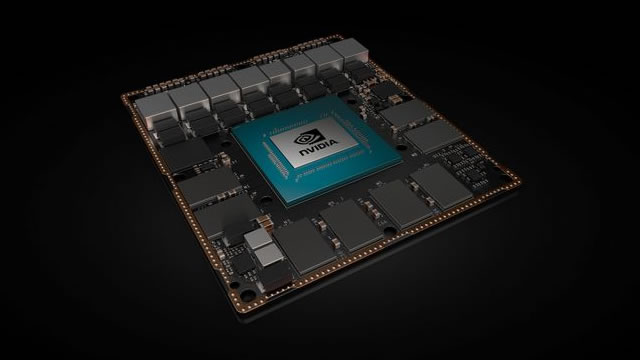

Additionally, you may want to keep a close eye on Nvidia’s future developments. The company is still a leader in AI and graphics processing units (GPUs). It has a strong pipeline of products, including its Hopper architecture for data centers and its Omniverse platform for creating and simulating 3D environments. These innovations could drive growth and potentially increase the value of your investment in Nvidia.

Impact on the World

The impact of Nvidia’s slowdown extends beyond just the tech industry and individual investors. The company’s technology plays a critical role in various industries, including gaming, data centers, and autonomous vehicles. A slowdown in Nvidia’s growth could have ripple effects.

For instance, the gaming industry could see a delay in the release of new, high-performance GPUs. This could impact the sales of new gaming consoles and PCs, as well as the revenue of game developers and publishers. Additionally, data centers that rely on Nvidia’s GPUs for machine learning and AI workloads could face increased costs or delays in their projects.

Looking Ahead

Despite the challenges, Nvidia remains a leader in its field. The company is continuing to innovate and invest in new technologies. Its recent acquisition of Arm, a leading designer of computer chips, could provide a significant boost to its business. Additionally, the growing demand for AI and machine learning in various industries could drive growth for Nvidia in the future.

As an investor or just a curious observer, it’s important to keep a long-term perspective. Nvidia’s current challenges are not insurmountable. The company has a strong track record of innovation and a pipeline of exciting products. With the right strategy and a bit of patience, you may still be able to benefit from Nvidia’s continued growth in the AI and tech industries.

- Nvidia reported fourth-quarter earnings last week, but the excitement and anticipation that surrounded the company a year or two ago have faded.

- A slowdown in the demand for data center chips and a shift in the gaming market are contributing to Nvidia’s challenges.

- Individual investors may want to reevaluate their investment strategy and keep a close eye on Nvidia’s future developments.

- The impact of Nvidia’s slowdown extends beyond the tech industry and individual investors, with potential ripple effects on the gaming industry and data centers.

- Despite the challenges, Nvidia remains a leader in its field and has a strong pipeline of products that could drive growth in the future.

In conclusion, Nvidia’s fourth-quarter earnings report marked a departure from the days of skyrocketing growth and endless opportunities in AI. However, it’s important to remember that the tech industry is dynamic, and companies face challenges and competition. As an investor or just a curious observer, it’s essential to keep a long-term perspective and stay informed about Nvidia’s future developments. With the right strategy and a bit of patience, you may still be able to benefit from Nvidia’s continued growth in the AI and tech industries.