Bitcoin miner revenue reshaped by Inscriptions, transaction fees hit $500M in 2023

An analysis of Bitcoin transaction fees

Over the past three years, there has been a noticeable shift in the dynamics of Bitcoin transaction fees. With miners relying more on transaction fees as block rewards decrease, the landscape of revenue generation in the industry has evolved significantly. In 2021, during the bull market, transaction fees soared above $1 billion, marking a significant milestone for the industry.

The changing role of miners

Traditionally, miners have earned the majority of their revenue through block rewards, which are gradually decreasing over time. This reduction has forced miners to adapt and rely more heavily on transaction fees to sustain their operations. As a result, the composition of miner revenue has been reshaped, with transaction fees playing a more prominent role in the overall revenue stream.

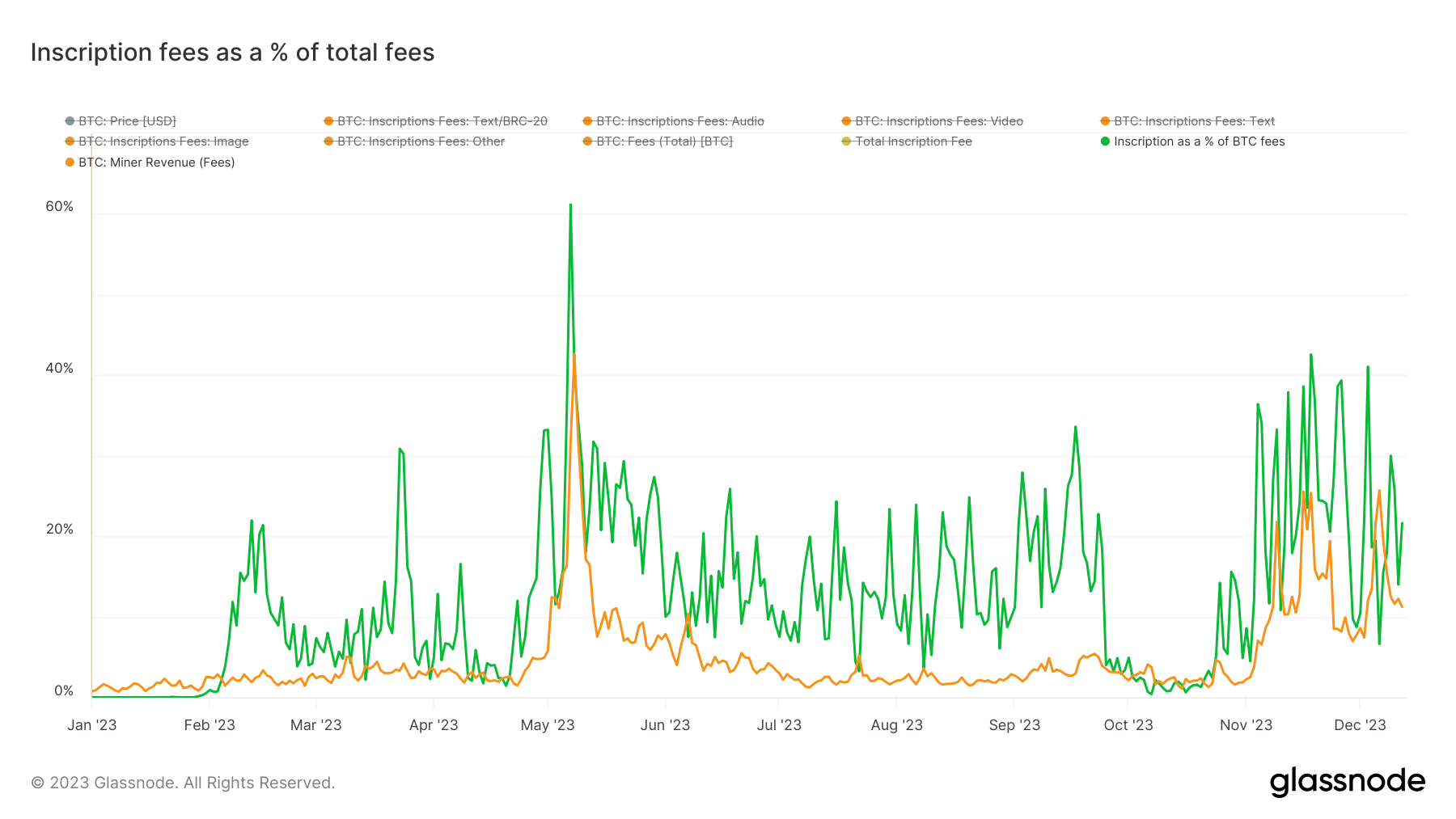

The impact of Inscriptions on transaction fees

One of the factors influencing the rise in transaction fees is the introduction of Inscriptions, which are digital signatures that validate the authenticity of transactions. These Inscriptions have added an additional layer of security to the Bitcoin network, but they have also increased the cost of processing transactions, leading to higher fees for users.

The future of Bitcoin transaction fees

Looking ahead, it is likely that transaction fees will continue to play a crucial role in the revenue generation of Bitcoin miners. As block rewards dwindle further, miners will have to innovate and find new ways to optimize their operations and maximize their profits. This shift in the industry is a clear indication of the maturation of the Bitcoin ecosystem and the need for sustainable revenue models for miners.

How will this impact me?

As a Bitcoin user, the increase in transaction fees may lead to higher costs for sending and receiving funds. It is important to factor in these fees when conducting transactions and to stay informed about the latest developments in the industry to make informed decisions.

How will this impact the world?

The shift in Bitcoin transaction fees and miner revenue has broader implications for the world economy. As Bitcoin continues to gain adoption and recognition as a legitimate form of currency, the sustainability of its revenue model will become increasingly important. The evolution of transaction fees and miner revenue is a reflection of the growing maturity and complexity of the cryptocurrency market, and it will likely have ripple effects across the global financial system.

Conclusion

In conclusion, the reshaping of Bitcoin miner revenue by Inscriptions and the increase in transaction fees to $500 million in 2023 is a significant development in the industry. This trend underscores the need for miners to adapt to changing market conditions and find innovative ways to sustain their operations. As users and stakeholders in the industry, it is crucial to stay informed about these changes and their potential impact on the wider economy.