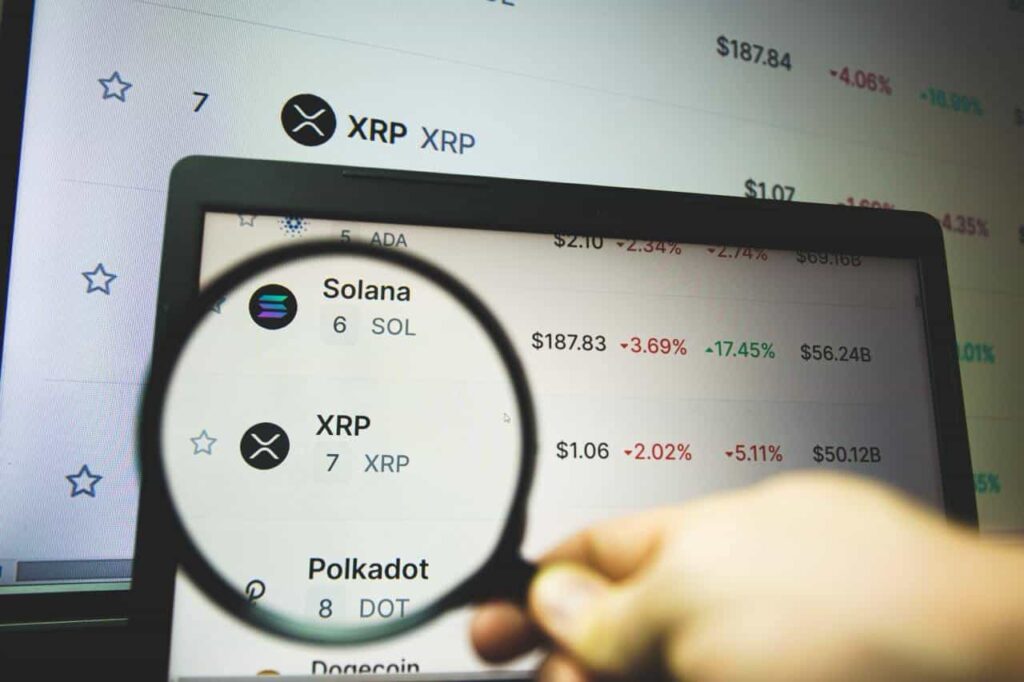

XRP’s Short-Term Recovery: A Closer Look

XRP, the digital asset often referred to as the “bridge currency” of Ripple’s payment protocol, has experienced a short-term price recovery. The asset, which was trading at around $1.70 at the beginning of March, has managed to hold above the crucial $2 support level. However, this uptick in price comes with a few caveats.

Technical Indicators Flashing Warning Signs

Despite the price recovery, technical indicators are flashing warning signs for XRP investors. The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) indicators are showing bearish signals, suggesting that the asset may be due for a correction. The RSI is currently sitting at around 60, which is considered overbought territory, while the MACD histogram is showing a bearish divergence with the price.

Impact on Individual Investors

For individual investors, the short-term recovery in XRP’s price may present an opportunity to enter the market at a slightly higher price point than before. However, it’s important to keep in mind the bearish signals from technical indicators and to consider the potential for a correction. As with any investment, it’s crucial to do thorough research and consider risk tolerance before making any decisions.

- Consider setting a stop-loss order to limit potential losses

- Keep an eye on technical indicators for further signals

- Diversify your portfolio to spread risk

Impact on the World

From a global perspective, the price recovery in XRP may have implications for the broader crypto market and the financial industry as a whole. Ripple’s payment protocol, which uses XRP as a bridge currency, has gained traction in the financial sector due to its fast and low-cost transactions. A strong XRP price could lead to increased adoption of the protocol, potentially disrupting traditional financial systems and increasing competition for traditional financial institutions.

Conclusion

In conclusion, XRP’s short-term recovery to hold above the $2 support level is a positive sign for investors, but it comes with cautionary signals from technical indicators. Individual investors should consider setting stop-loss orders, keeping an eye on technical indicators, and diversifying their portfolios. From a global perspective, a strong XRP price could lead to increased adoption of Ripple’s payment protocol and disruption of traditional financial systems.

It’s important to remember that the crypto market is volatile and subject to rapid price movements. Stay informed and stay cautious when making investment decisions.