The Future of Bitcoin and Government Reserves: A State-Led Revolution

The cryptocurrency world has been abuzz with the recent push for a national Bitcoin reserve in the United States. Senator Cynthia Lummis (R-WY), a known advocate for Bitcoin, has been leading the charge, believing that holding Bitcoin in the federal government’s reserves is a smart investment. However, the reality of a national Bitcoin reserve may not be happening anytime soon.

Why a National Bitcoin Reserve is Unlikely

Several factors contribute to the uncertainty of a national Bitcoin reserve. For one, the U.S. government’s stance on Bitcoin remains ambiguous. The Internal Revenue Service (IRS) considers Bitcoin to be property for tax purposes, while the Securities and Exchange Commission (SEC) treats it as a security in some cases. This regulatory uncertainty makes it difficult for the government to hold Bitcoin as a reserve asset.

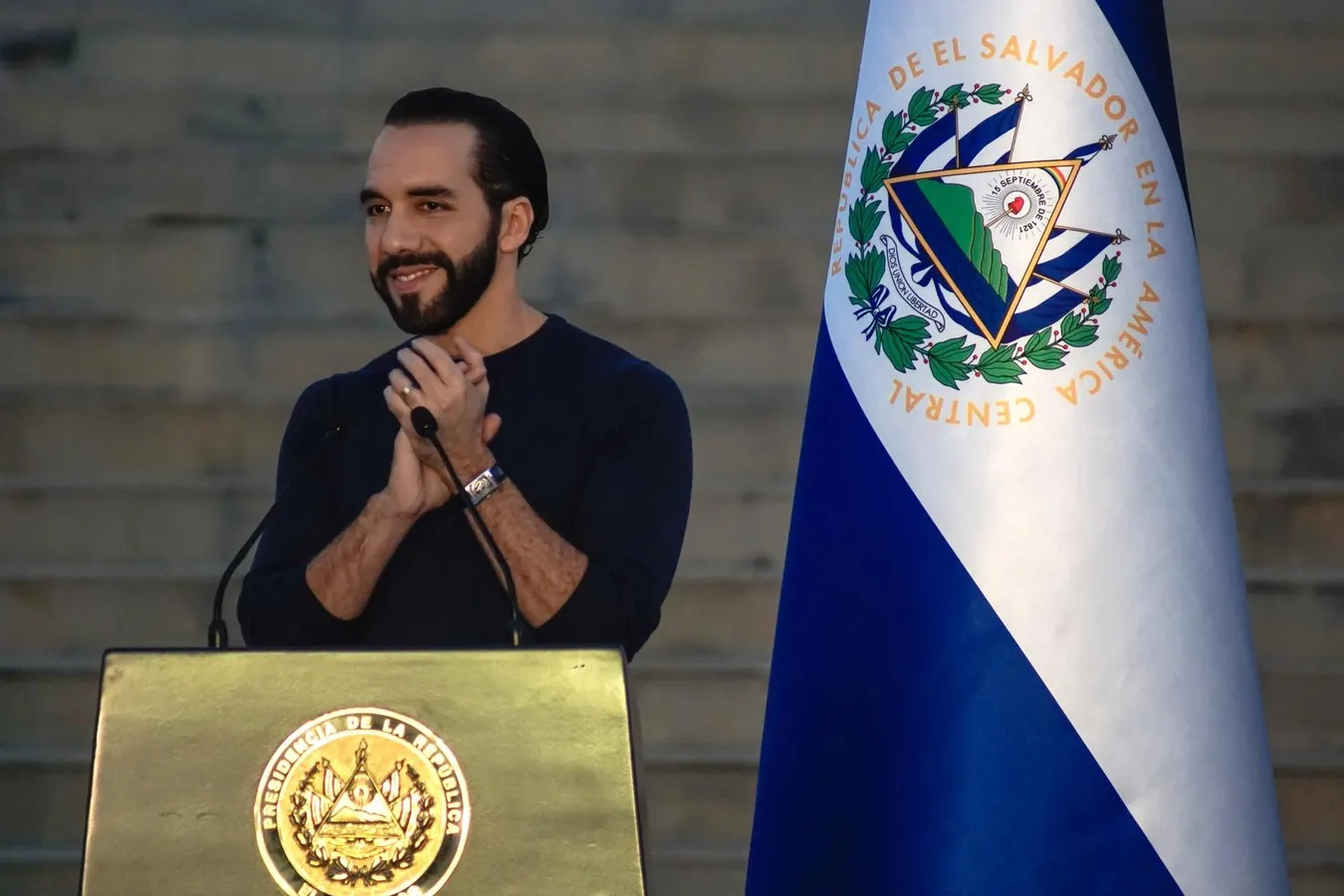

States Taking the Lead

Despite the federal government’s hesitancy, some states are taking matters into their own hands. New York, for example, has been exploring the possibility of creating a state-chartered digital asset bank. This bank would allow the state to hold Bitcoin and other digital assets as part of its reserves. Other states, such as Texas, have already started buying Bitcoin as part of their reserves.

Impact on Individuals

For individuals, the rise of state-led Bitcoin reserves could lead to increased adoption and legitimacy of cryptocurrencies. As more states invest in Bitcoin, it may become more widely accepted as a legitimate asset class. This could lead to more investment opportunities and potentially higher returns for those who invest early.

- Increased adoption and legitimacy of cryptocurrencies

- More investment opportunities

- Potentially higher returns for early investors

Impact on the World

On a larger scale, the adoption of state-led Bitcoin reserves could have significant implications for the global economy. It could lead to a shift away from traditional fiat currencies and towards decentralized digital assets. This could result in more financial freedom for individuals and businesses and potentially reduce the power of central banks.

- Shift away from traditional fiat currencies

- Increased financial freedom for individuals and businesses

- Reduced power of central banks

Conclusion

The push for a national Bitcoin reserve in the United States may not be happening anytime soon, but states are taking the lead in this area. As more states invest in Bitcoin and other digital assets, it could lead to increased adoption and legitimacy of cryptocurrencies. This could have significant implications for individuals and the world as a whole, potentially leading to more financial freedom and a shift away from traditional fiat currencies.

For those interested in investing in Bitcoin or other digital assets, it’s important to stay informed about regulatory developments and market trends. As the landscape continues to evolve, there may be opportunities to invest in this exciting and innovative asset class.