XRP’s Persistent Downtrend: A Concern for Market Participants

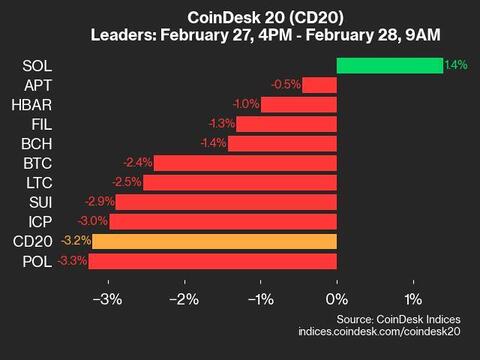

The cryptocurrency market is known for its volatility, but the continuous decline of XRP has raised eyebrows and concern amongst market participants. At the current moment, XRP is experiencing a 10% decrease in value, adding to the more than 30% loss it has incurred over the past month.

Historical Performance

XRP, the native digital asset of Ripple Labs, was once a top performer in the cryptocurrency market. In late 2017, the asset reached an all-time high of $3.84. However, since then, it has been on a downward trend, with occasional brief recoveries.

Factors Contributing to the Decline

Several factors have contributed to XRP’s persistent downtrend. One significant factor is the ongoing legal battle between Ripple Labs and the U.S. Securities and Exchange Commission (SEC) over the classification of XRP as a security. This uncertainty has caused potential investors to hesitate, contributing to the asset’s price decline.

Another factor is the increasing competition in the cryptocurrency market. With the rise of decentralized platforms and newer, more innovative projects, XRP’s position as a top contender has weakened, leading to a loss of investor interest.

Impact on Individual Investors

For individual investors holding XRP, the persistent decline in price can be a source of frustration and concern. Those who bought the asset at its peak price are likely experiencing significant losses. However, it is essential to remember that investing in cryptocurrencies always comes with risk, and market volatility is a given.

Impact on the Global Economy

The decline in XRP’s value can also have wider implications for the global economy. Ripple’s technology is used by several financial institutions for cross-border payments, and XRP acts as a bridge currency in these transactions. A significant decline in XRP’s value could make these transactions more expensive, potentially impacting the efficiency and cost-effectiveness of the global financial system.

Potential for a Correction

Despite the concerns, it is important to note that XRP remains well-positioned for a much-needed correction. The asset has a strong use case and a dedicated user base. Additionally, the ongoing legal battle with the SEC is likely to be resolved soon, which could lead to a renewed interest in XRP.

Conclusion

The persistent decline in XRP’s value has caused concern amongst market participants, but it is essential to remember that investing in cryptocurrencies always comes with risk. While the ongoing legal battle and increasing competition are significant factors contributing to XRP’s downtrend, the asset remains well-positioned for a potential correction. For individual investors, it is crucial to diversify their portfolio and stay informed about market developments.

- XRP has experienced a 10% decrease in value at press time, adding to the more than 30% loss over the past month.

- The asset’s persistent downtrend can be attributed to several factors, including legal uncertainty and increasing competition.

- For individual investors, the decline in XRP’s value can be frustrating, but it is essential to remember the risks associated with investing in cryptocurrencies.

- The decline in XRP’s value could have wider implications for the global economy, potentially impacting the efficiency and cost-effectiveness of the global financial system.

- Despite the concerns, XRP remains well-positioned for a potential correction, with a strong use case and dedicated user base.