Aave (AAVE) and Uniswap (UNI): A Tale of Two DeFi Tokens

In the ever-evolving world of decentralized finance (DeFi), two prominent players, Aave (AAVE) and Uniswap (UNI), have recently made headlines. While Uniswap enjoyed a surge in price and market dominance, Aave underperformed, declining approximately 7% from Thursday.

Aave’s Decline

Aave, an open-source and non-custodial decentralized lending protocol built on Ethereum, has seen its share of ups and downs in the market. After reaching an all-time high of $527.21 on May 13, AAVE’s price has been on a downward trend. On Thursday, the token was priced at $360.31. By the following day, it had dropped to $335.53, marking a 7% decline.

Factors Contributing to Aave’s Decline

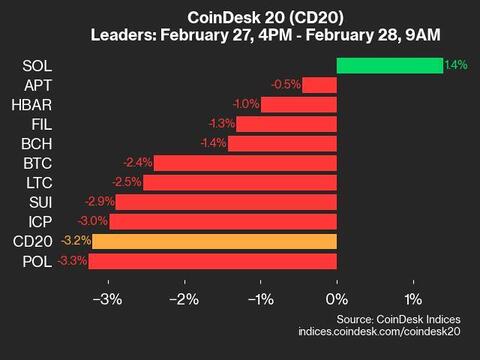

Several factors may have contributed to Aave’s decline. One possible reason is the overall market sentiment and volatility. The cryptocurrency market has been experiencing significant fluctuations, with Bitcoin and Ethereum both experiencing price drops. This market instability may have led to a sell-off of AAVE, as investors sought to minimize their risks.

Another factor could be the increasing competition in the decentralized lending space. With projects like Compound (COMP) and Maker (MKR) also vying for market share, investors may be shifting their attention and resources to these projects, leading to a decrease in demand for AAVE.

Uniswap’s Surge

Meanwhile, Uniswap, a decentralized automated market maker protocol, has been on an upward trend. After a relatively quiet start to the year, Uniswap’s UNI token saw a dramatic increase in price and market dominance. The token reached an all-time high of $37.31 on May 14, up from $1.88 just a week earlier.

Factors Contributing to Uniswap’s Surge

Several factors have contributed to Uniswap’s surge. One major factor is the announcement of Uniswap’s upcoming governance token, UNI. The token, which was distributed to past users of the platform, gave existing users a sense of ownership and incentivized them to hold and trade UNI. Additionally, the token’s distribution event created a significant amount of buzz and excitement in the community, driving up the price.

Impact on Individual Investors

For individual investors, the decline in Aave’s price may be a cause for concern, especially if they have a significant investment in AAVE. However, it is important to remember that the cryptocurrency market is inherently volatile and that short-term price fluctuations are to be expected. Long-term investors may view this as an opportunity to buy AAVE at a lower price and hold onto it for potential future gains.

Impact on the World

The decline in Aave’s price and the surge in Uniswap’s price have broader implications for the decentralized finance space as a whole. The volatility in the market highlights the risks and rewards of investing in decentralized finance projects. It also underscores the importance of diversification and careful risk management for investors.

Conclusion

In conclusion, the recent price fluctuations of Aave and Uniswap serve as a reminder of the inherent risks and rewards of investing in the decentralized finance space. While the decline in Aave’s price may be disheartening for some investors, it also presents an opportunity for long-term investors to buy at a lower price. Meanwhile, the surge in Uniswap’s price highlights the potential for decentralized finance projects to disrupt traditional financial systems and create new opportunities for innovation and growth.

As the decentralized finance space continues to evolve, it is important for investors to stay informed and make informed decisions based on their risk tolerance and investment goals. Whether you are a seasoned investor or just starting out, it is essential to approach the market with a long-term perspective and a solid understanding of the underlying technology and market dynamics.

- Aave (AAVE) experienced a 7% decline in price from Thursday.

- Uniswap (UNI) saw a surge in price and market dominance.

- Factors contributing to Aave’s decline include market volatility and competition.

- Factors contributing to Uniswap’s surge include the upcoming UNI governance token and community excitement.

- Individual investors should approach the market with a long-term perspective and careful risk management.