The Bank of England May 2024 Decision

What to Expect

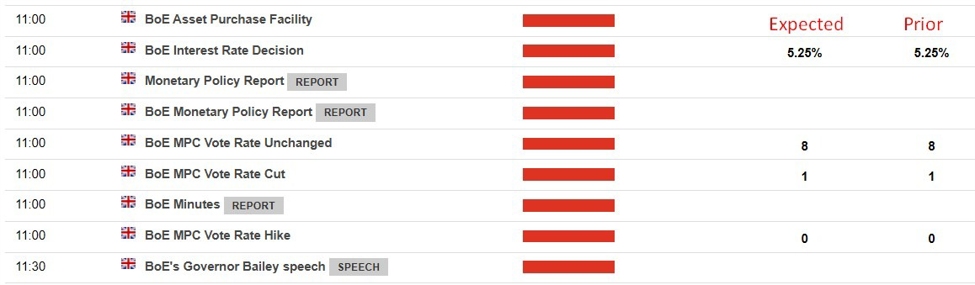

The Bank of England may 2024 decision is due on Thursday at 0700 US Eastern time. On hold expected. Earlier, Deutsche Bank is expecting the Monetary Policy Committee to “set the stage for a June rate cut”. HSBC are also expecting the first rate cut to come in June according to Deutsche Bank.

Oxford Economics stated that the data published in mid-April for services inflation and private sector regular pay growth has likely extinguished any remaining hopes of a move in rates.

Impact on Individuals

For individuals, a rate cut by the Bank of England could potentially lead to lower borrowing costs, making it cheaper to take out loans for mortgages, personal loans, and credit cards. However, it could also mean lower returns on savings accounts and other interest-bearing investments.

Impact on the World

The decision by the Bank of England can have a ripple effect on the global economy. A rate cut could stimulate economic growth in the UK and potentially boost international trade. However, it could also lead to currency devaluation and impact foreign exchange markets.

Conclusion

Overall, the Bank of England’s May 2024 decision is highly anticipated, with expectations leaning towards a hold this time but possibly setting the stage for a rate cut in June. Individual borrowers and savers, as well as the global economy, will be closely watching the outcome and its implications.