Bitcoin as Portfolio Insurance: A Safe Haven in Uncertain Times

In the rapidly evolving world of finance, investors are constantly seeking ways to mitigate risks and protect their assets. A recent report by crypto asset manager Bitwise has shed new light on Bitcoin’s potential role as “portfolio insurance” against sovereign default risks. This comes at a time when global debt-to-GDP levels are reaching new highs, fueling concerns about a potential global debt crisis.

The Global Debt Crisis: A Growing Concern

According to data from the International Monetary Fund (IMF), global debt levels surpassed $253 trillion in 2019, representing a 6% increase from the previous year. This trend is not unique to any one region; both developed and emerging markets are experiencing a surge in debt levels. For instance, the European Union’s debt-to-GDP ratio stands at around 85%, while Japan’s is a staggering 250%. The United States, though lower at 107%, is still a significant player in the global debt market.

Bitcoin: A Potential Hedge Against Sovereign Default Risks

Amidst these growing debt levels, Bitcoin has emerged as a potential hedge against sovereign default risks. The cryptocurrency’s decentralized and borderless nature makes it an attractive alternative to traditional assets during times of economic uncertainty. Bitcoin’s price has historically shown a negative correlation with traditional assets such as stocks and bonds, suggesting that it could serve as a diversification tool in a portfolio.

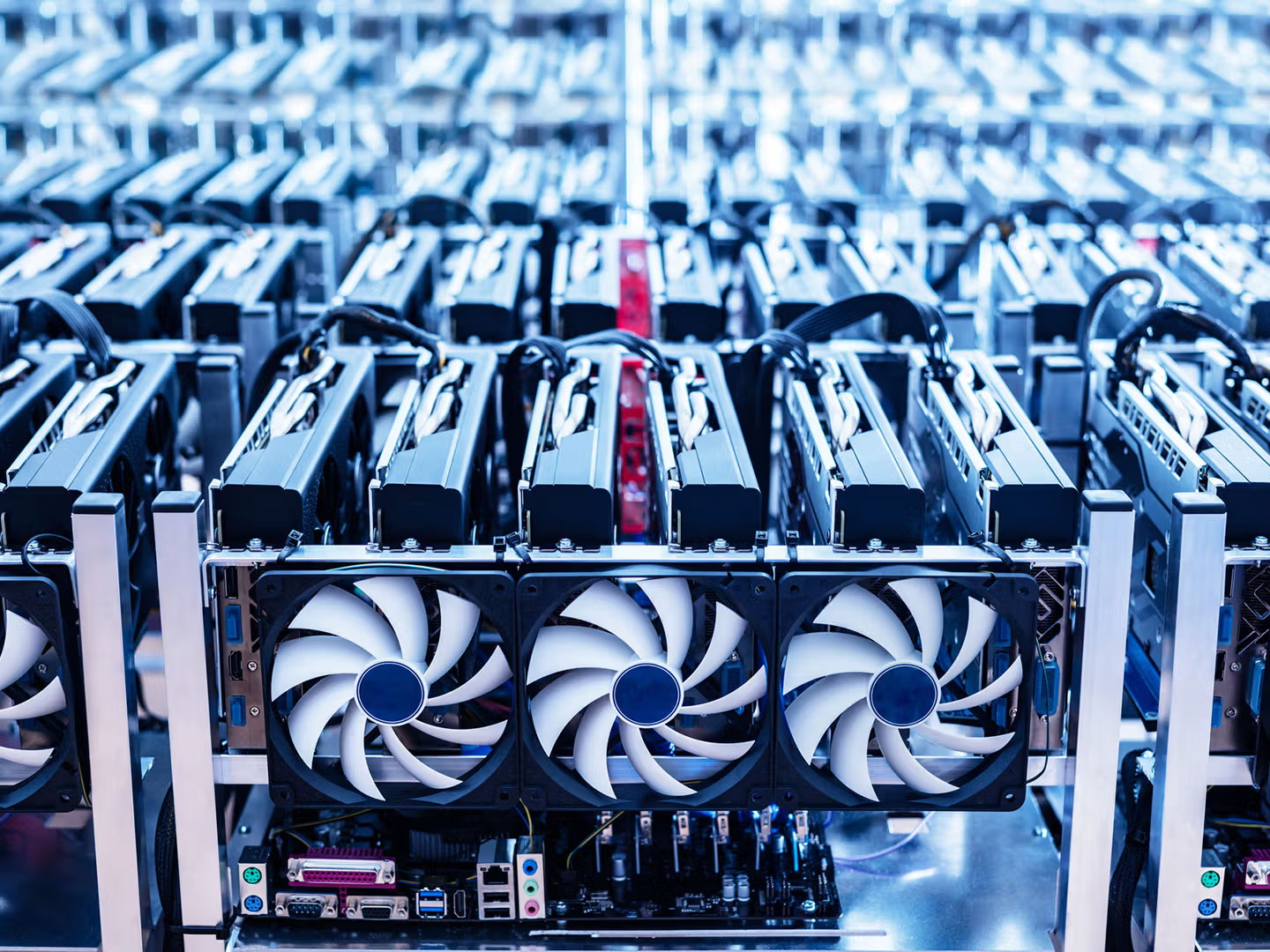

The Role of Bitcoin as Portfolio Insurance: A Closer Look

The Bitwise report highlights several factors that make Bitcoin an effective portfolio insurance. Firstly, its limited supply of 21 million tokens ensures scarcity, making it a valuable store of value. Secondly, its decentralized nature makes it immune to political instability and government intervention, providing a level of protection against sovereign risks. Lastly, its 24/7 trading market and global accessibility make it a highly liquid asset, allowing investors to buy and sell quickly in times of need.

The Impact on Individuals: Protecting Your Wealth

For individuals, investing in Bitcoin as portfolio insurance could offer a number of benefits. By diversifying your portfolio with Bitcoin, you can potentially mitigate the risks associated with traditional assets during times of economic instability. Moreover, Bitcoin’s decentralized nature makes it an attractive alternative to holding cash, which may lose value due to inflation.

The Impact on the World: A Shift in the Financial Landscape

On a larger scale, the increasing adoption of Bitcoin as portfolio insurance could have profound implications for the global financial landscape. As more investors turn to Bitcoin as a hedge against sovereign risks, the demand for the cryptocurrency could increase, potentially driving up its price. This could lead to a shift in the balance of power from traditional financial institutions to decentralized digital currencies.

Conclusion: Navigating Uncertainty with Bitcoin

In conclusion, the growing global debt levels and the potential for a debt crisis have highlighted the need for alternative assets that can serve as effective portfolio insurance. Bitcoin, with its decentralized, borderless, and highly liquid nature, is an attractive option for investors seeking to mitigate sovereign default risks. As the financial landscape continues to evolve, it is essential for investors to stay informed and adapt to new opportunities. Bitcoin, as a potential hedge against uncertainty, is a trend worth watching.

- Global debt levels have reached new highs, with the International Monetary Fund reporting a total of $253 trillion in 2019.

- Bitcoin has emerged as a potential hedge against sovereign default risks due to its decentralized, borderless, and highly liquid nature.

- Investing in Bitcoin as portfolio insurance could offer individuals protection against economic instability and inflation.

- The increasing adoption of Bitcoin as portfolio insurance could have profound implications for the global financial landscape.