Is The Charles Schwab Corporation (SCHW) a Top Stock Pick for Momentum Investors?

Hey there, curious investor! Today, we’re going to take a peek at The Charles Schwab Corporation (SCHW) and see if it’s worth considering for those of us chasing after the elusive momentum train. But before we dive in, let’s make sure we’re all on the same page. Momentum investing is a strategy that involves buying stocks that have been performing exceptionally well, with the hope that their upward trend will continue.

A Brief Overview of The Charles Schwab Corporation

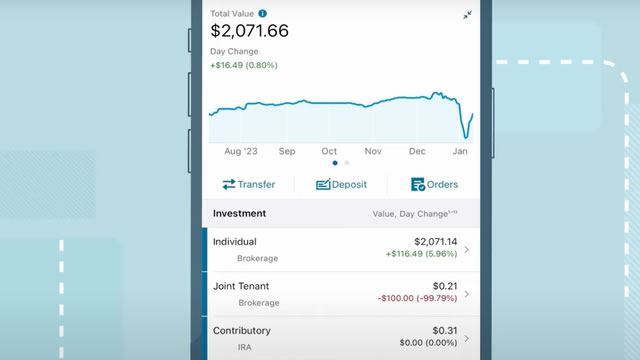

First things first, let’s get to know SCHW a little better. The Charles Schwab Corporation is a leading provider of financial services, with a focus on investment management, trading, and custodial services. They offer a range of products and services for individual investors, as well as institutional clients. And with over $6.5 trillion in assets under management and administration, they’ve got some serious clout in the industry.

Momentum Indicators: What Do They Say About SCHW?

Now, let’s talk momentum. According to various technical indicators, SCHW has been making some impressive strides. For instance, its 50-day moving average has been consistently rising since early 2021, while its 200-day moving average has been playing catch-up since late last year. This suggests that the stock’s recent upward trend is strong and sustained.

Financial Performance: A Closer Look

But it’s not just about moving averages. Let’s take a look at SCHW’s financial performance. In their most recent quarterly report, they posted earnings per share (EPS) of $0.69, which beat analysts’ estimates by $0.03. Revenue also came in higher than expected, with a year-over-year growth rate of 12%.

Dividends: A Sweetener for Momentum Investors?

Some investors might be wondering if SCHW’s dividend yield is worth considering. Currently, it stands at around 1.2%, which isn’t exactly eye-catching. However, it’s important to note that SCHW has a history of increasing its dividend payout annually, which could make it an attractive addition to a momentum investor’s portfolio.

What Does This Mean for Me?

If you’re a momentum investor, SCHW might be worth adding to your watchlist. Its strong financial performance and upward trending moving averages are certainly promising. But as with any investment, it’s important to do your own research and consider your personal risk tolerance. And remember, past performance is not indicative of future results.

What Does This Mean for the World?

From a broader perspective, SCHW’s success could have implications for the financial services industry as a whole. As more and more investors turn to digital platforms for their investment needs, companies like SCHW that offer user-friendly, tech-driven solutions are likely to thrive. This could lead to increased competition and innovation in the industry, ultimately benefiting consumers.

wrapping up

There you have it, folks! The Charles Schwab Corporation (SCHW) seems to be making some serious moves in the momentum investing world. With its strong financial performance and upward trending moving averages, it’s definitely worth keeping an eye on. But as always, do your own research and consider your personal risk tolerance before making any investment decisions. And remember, even the most successful momentum stocks can experience downturns, so always be prepared for the ride!

- The Charles Schwab Corporation (SCHW) is a leading provider of financial services

- Momentum investing involves buying stocks with exceptional performance

- SCHW’s 50-day and 200-day moving averages have been rising since early 2021

- SCHW posted earnings and revenue that beat analysts’ estimates in their most recent quarterly report

- SCHW has a history of increasing its dividend payout annually

- The financial services industry could see increased competition and innovation due to SCHW’s success