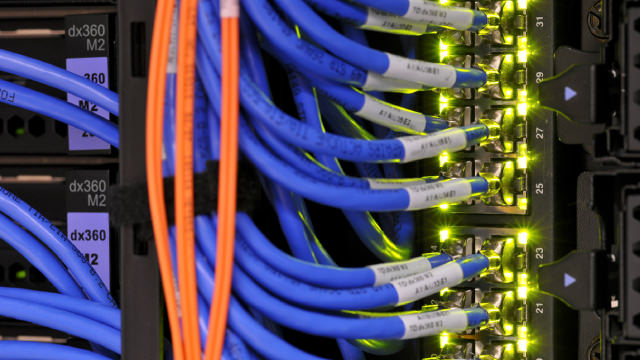

HPE’s Upcoming Earnings Report: What to Expect

Hewlett Packard Enterprise (HPE), the technology company known for its innovative solutions in areas like hybrid cloud, edge-to-core, AI, and Intelligent Edge, is gearing up to release its upcoming earnings report. While the anticipation is high, there are concerns that HPE might not meet the earnings expectations for this quarter.

Two Key Ingredients Missing

According to recent financial analyst reports, HPE is currently facing a shortage of two key ingredients that could negatively impact its earnings:

- Demand: There’s a slowdown in demand for HPE’s offerings, particularly in the areas of servers and storage. This trend is affecting not only HPE but also its competitors.

- Supply Chain Challenges: HPE is experiencing supply chain disruptions due to ongoing geopolitical tensions and semiconductor shortages. These issues have resulted in production delays, which could impact HPE’s ability to meet customer demand and, consequently, its earnings.

Impact on Individual Investors

For individual investors holding HPE stocks, this news could mean a potential decrease in stock value. However, it is essential to remember that earnings reports are just one factor in determining a stock’s value. Other factors, such as the company’s long-term growth potential, financial health, and competitive landscape, should also be considered.

Impact on the Technology Industry and the World

The technology industry, and by extension the world economy, is closely connected. HPE’s earnings report is just one piece of the puzzle, but it could indicate broader trends in the tech sector. If HPE’s earnings miss the mark, it could signal that the technology market is experiencing a downturn. This could indirectly impact other industries, such as software, services, and manufacturing, that are interconnected with the tech sector.

Conclusion

HPE’s upcoming earnings report is a cause for concern due to the company’s potential shortfall in the key ingredients necessary for a likely earnings beat. With a slowdown in demand and supply chain challenges, HPE’s earnings could be negatively impacted. This news could potentially affect individual investors holding HPE stocks, as well as the technology industry and the world economy at large. However, it is essential to remember that earnings reports are just one factor in determining a company’s value, and long-term growth potential, financial health, and competitive landscape should also be considered.

As we wait for HPE’s earnings report, it’s a good time for investors to reassess their investment strategies and consider the potential risks and opportunities in the technology sector. Stay informed and stay prepared.