Cryptocurrency Market: Mixed Performances and the Dawn of Selective Altcoin Season

The cryptocurrency market has been a rollercoaster ride in recent days, with Bitcoin (BTC) taking the lead in displaying volatile price movements. Despite the overall bearish sentiment in the market, some altcoins have shown signs of resilience, indicating the potential start of a selective altcoin season.

Bitcoin Plunges Below $83,000

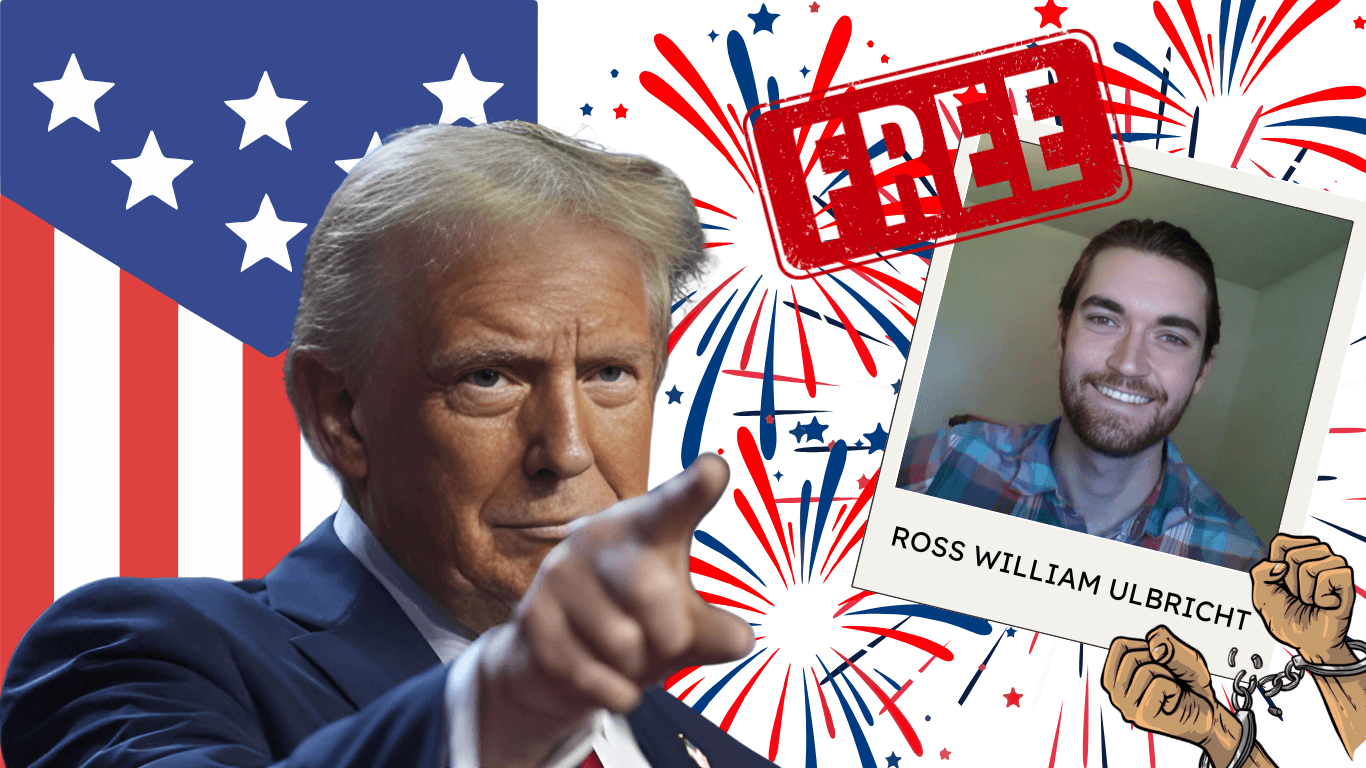

Bitcoin, the largest cryptocurrency by market capitalization, took a significant hit as bearish sentiments grew in the market. The leading cryptocurrency plunged below $83,000, reaching a daily low of $82,222. The decline was attributed to various factors, including the ongoing global economic uncertainty and the announcement of new tariffs by former President Trump.

Altcoins Bounce Back: APT Surges Nearly 15%

Amidst the bearish sentiment surrounding Bitcoin, some altcoins have managed to record substantial bounce-backs within the past day. One such altcoin is Aptos Cash (APT), which surged nearly 15% from its daily lows of $5.5411 to reach a high of $6.3695. This impressive recovery indicates that altcoins may decouple from Bitcoin and start to chart their own price courses.

The Impact on Individual Investors

- Diversification: With Bitcoin’s price volatility, investors may consider diversifying their portfolios by investing in a mix of cryptocurrencies, including altcoins.

- Patience and Research: The cryptocurrency market is known for its volatility, and investors need to be patient and conduct thorough research before making investment decisions.

- Risk Management: It’s essential to manage risk effectively by setting stop-loss orders and limiting exposure to any single asset.

The Impact on the Global Economy

- Regulatory Clarity: Clear regulatory frameworks for cryptocurrencies in various countries could help stabilize the market and reduce volatility.

- Adoption: Widespread adoption of cryptocurrencies as a legitimate form of currency and investment could lead to increased stability in the market.

- Innovation: Continued innovation in the blockchain space could lead to the development of more stable and reliable cryptocurrencies.

Conclusion

The cryptocurrency market continues to display mixed performances, with Bitcoin leading the charge in price volatility. However, the recent bounce-backs by some altcoins indicate that they may decouple from Bitcoin and chart their own price courses. This could lead to a selective altcoin season, where investors focus on specific altcoins with potential. As an investor, it’s essential to manage risk effectively, conduct thorough research, and consider diversifying your portfolio. Meanwhile, the global economy could benefit from regulatory clarity, widespread adoption, and continued innovation in the blockchain space.

Stay informed and make informed investment decisions!