Nvidia’s Earnings Beat overshadowed by Disappointing Guidance

Despite reporting better-than-expected earnings for the fourth quarter of fiscal 2021, Nvidia (NVDA) shares experienced a slight dip in after-hours trading on Wall Street. The chip giant posted earnings per share (EPS) of $1.14, surpassing analysts’ estimated EPS of $1.03. Moreover, the company’s revenue came in at $6.71 billion, higher than the projected $6.43 billion. However, Nvidia’s guidance for the first quarter of fiscal 2022 fell short of expectations, leading to the stock’s decline.

CEO Jensen Huang’s Optimistic Outlook

In an interview with CNBC, Nvidia’s CEO, Jensen Huang, expressed his optimism about the company’s future, dismissing the threat of lower-cost competitors. Huang stated, “We’re not focused on competition; we’re focused on delivering unique value to our customers.” He further added, “Our customers want the best, and they’re willing to pay for the best.”

Impact on Individual Investors

For individual investors, Nvidia’s earnings report and subsequent stock price reaction could mean both opportunities and risks. Those who had faith in the company’s financial performance and bought the stock at a lower price before the earnings release could potentially see a return on their investment. On the other hand, investors who bought the stock after the earnings report, expecting a continued upward trend, might experience losses if they decide to sell at a lower price.

Global Implications

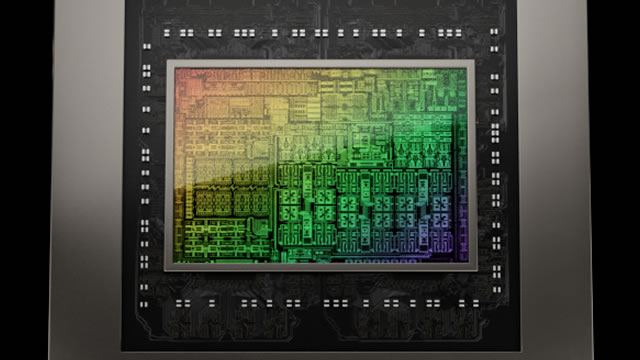

The tech industry, particularly the semiconductor sector, will be affected by Nvidia’s earnings report and guidance. The success of Nvidia, a leading player in the graphics processing unit (GPU) market, influences the demand for high-performance computing solutions. Moreover, the company’s focus on artificial intelligence (AI) and data center markets indicates a growing trend towards advanced technologies. This, in turn, could impact other tech companies and industries that rely on semiconductors and AI.

Conclusion

Nvidia’s earnings beat did not provide enough reassurance for Wall Street, as the company’s guidance for the upcoming quarter fell short of expectations. However, CEO Jensen Huang remains confident in Nvidia’s ability to deliver value to its customers and compete in the market. For individual investors, this report presents both opportunities and risks, while the tech industry and global semiconductor market will be affected by Nvidia’s performance and the broader trends in AI and high-performance computing.

- Nvidia reports better-than-expected earnings for Q4 2021

- Stock experiences slight dip due to disappointing guidance

- CEO Jensen Huang remains optimistic about the company’s future

- Impact on individual investors: potential returns or losses

- Global implications: influence on tech industry and semiconductor market