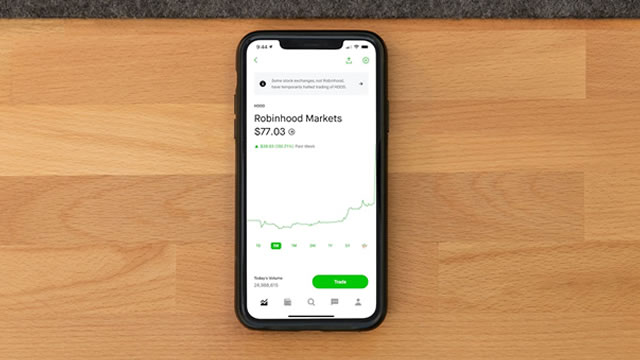

Robinhood’s Slump: A Buying Opportunity or a Warning Sign?

In the past week, Robinhood Markets, Inc. (HOOD) shares have experienced a significant decline, shedding approximately 24% of their value. This drop has raised eyebrows among investors, leaving many wondering whether this is a golden buying opportunity or a warning sign of deeper trouble for the online brokerage platform.

A Closer Look at Robinhood’s Slump

The selloff began on February 8, 2023, when Robinhood reported its fourth-quarter earnings. The company’s revenue missed analysts’ estimates, and its forecast for the first quarter fell short of expectations as well. Despite these disappointing figures, Robinhood’s CEO, Vlad Tenev, expressed optimism about the company’s future growth prospects.

Impact on Individual Investors

For individual investors, the sudden decline in Robinhood’s stock price presents a dilemma. Those who bought HOOD shares at their peak may be considering selling to minimize their losses. However, those who view the current price as an opportunity may choose to buy, hoping for a rebound. It’s essential to remember that investing always carries risk, and it’s crucial to do thorough research and consider personal financial circumstances before making any decisions.

- Consider your investment goals and risk tolerance.

- Stay informed about the company’s financial performance and industry trends.

- Seek advice from financial advisors or trusted resources.

Impact on the Broader Market

Robinhood’s slump is not an isolated event. The stock market as a whole has experienced volatility in recent weeks, with the S&P 500 and Nasdaq Composite indexes also experiencing declines. While Robinhood’s struggles may be a reflection of its specific financial situation, it could also be a sign of broader market trends. Economic uncertainty, inflation, and geopolitical tensions are all factors that can impact the stock market.

It’s important to note that short-term market fluctuations are a normal part of investing. However, it’s crucial to stay informed and adapt to changing market conditions. Diversification and a long-term investment strategy can help mitigate risk and potentially yield better returns over time.

Conclusion

Robinhood’s recent decline presents a conundrum for investors. While some may see it as a buying opportunity, others may view it as a warning sign. It’s essential to remember that investing always carries risk, and it’s crucial to do thorough research and consider personal financial circumstances before making any decisions. Additionally, the broader market trends should be taken into account when evaluating the potential impact of Robinhood’s struggles.

As always, it’s important to stay informed and adapt to changing market conditions. By staying informed, diversifying investments, and maintaining a long-term perspective, investors can navigate market volatility and potentially achieve their financial goals.

Remember, investing is not a get-rich-quick scheme. It requires patience, discipline, and a solid understanding of the risks and rewards involved. By taking a thoughtful, informed approach, investors can make the most of market fluctuations and build a strong, resilient investment portfolio.