The Magnificent Seven: Tech Stocks Taking a Dive

In the ever-evolving world of technology, some stocks have earned a reputation for their impressive gains. Known as the “Magnificent Seven,” these high-flying tech companies have captured the hearts and wallets of investors. However, recently, these stocks have taken a tumble, leaving many wondering what’s causing the correction.

The Magnificent Seven: Who Are They?

The Magnificent Seven refers to seven tech stocks that have seen significant growth in recent years. These companies include Nvidia, Microsoft, Apple, Amazon, Alphabet (Google), Facebook, and Tesla. These stocks have been a staple in many investment portfolios due to their strong earnings reports and promising futures.

Why the Correction?

The reasons for the correction vary, but one significant factor is the Federal Reserve’s recent interest rate hikes. The Federal Reserve has been raising interest rates to combat inflation, which can make stocks less attractive to investors. Additionally, some investors are becoming concerned about the valuations of these tech stocks, which have been trading at high multiples.

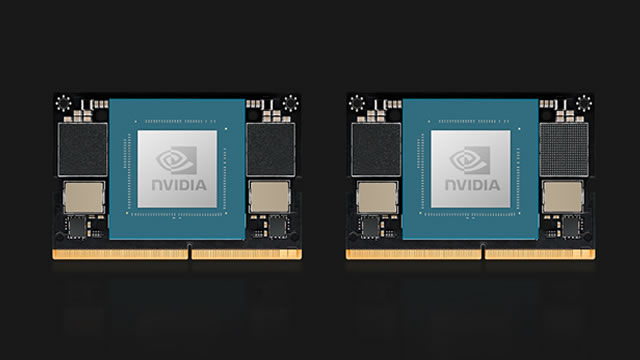

Nvidia: A Case Study

Let’s take a closer look at Nvidia, one of the Magnificent Seven. Nvidia is a leading manufacturer of graphics processing units (GPUs) and is known for its expertise in artificial intelligence (AI) and gaming. In the past year, Nvidia’s stock price has more than doubled, making it an attractive investment for many. However, in recent weeks, Nvidia’s stock has taken a hit, with shares dropping by over 20%.

The decline in Nvidia’s stock price can be attributed to several factors. One reason is the slowing demand for GPUs in the cryptocurrency market. Cryptocurrency mining requires significant computing power, which can be provided by GPUs. However, the price of Bitcoin and other cryptocurrencies has been volatile, leading to a decrease in demand for GPUs.

Impact on Individual Investors

For individual investors, the correction in tech stocks can be a cause for concern. If you have invested in any of the Magnificent Seven, you may be feeling a sense of unease as you watch the value of your investments decline. However, it’s important to remember that corrections are a normal part of the market cycle. It’s also a good time to reassess your investment strategy and consider diversifying your portfolio.

Impact on the World

The correction in tech stocks can also have a ripple effect on the wider economy. Tech companies are major contributors to economic growth, and their success can lead to job creation and innovation. A correction in tech stocks can lead to job losses and a slowdown in innovation. Additionally, the correction can impact the valuations of other stocks and the overall market.

- Job losses: A correction in tech stocks can lead to job losses, particularly in industries related to tech.

- Innovation: Tech companies are often at the forefront of innovation, and a correction can slow down the pace of innovation.

- Market impact: The correction can impact the valuations of other stocks and the overall market.

Conclusion

The correction in the Magnificent Seven tech stocks can be a cause for concern for individual investors and the wider economy. However, it’s important to remember that corrections are a normal part of the market cycle. It’s a good time to reassess your investment strategy and consider diversifying your portfolio. Additionally, the impact of the correction on the wider economy will depend on how long it lasts and how severe it is.

As we wait for Nvidia’s earnings report, investors will be closely watching to assess the health of the tech sector. Regardless of the outcome, it’s important to stay informed and stay calm during market volatility.

Investing always comes with risk, and it’s important to remember that past performance is not indicative of future results. Stay tuned for more updates on the tech sector and the Magnificent Seven.