Stellantis: A Multinational Auto Giant Navigating Challenges Towards Growth

Stellantis N.V., the multinational automobile manufacturing corporation, is gearing up for a resurgence in 2025 following a significant decline in its earnings for the year 2024. This global powerhouse, which oversees renowned automotive brands such as Dodge, Jeep, Fiat, Chrysler, and Peugeot, reported a full-year net profit of €5.5 billion ($5.77 billion), marking a substantial 70% decrease from the €18.6 billion ($19.95 billion) recorded in the previous year, 2023.

Causes of the Financial Downturn

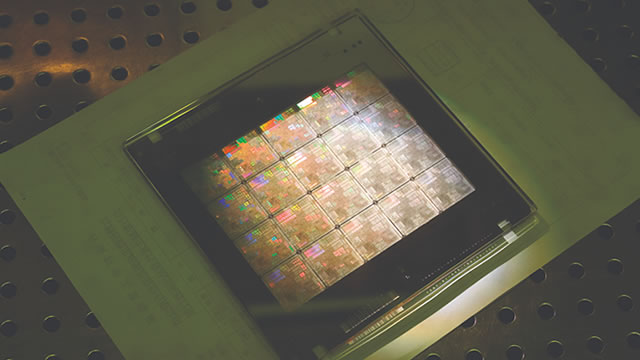

The sharp decline in Stellantis’ earnings can be attributed to several factors. One of the most significant factors was the global semiconductor shortage, which disrupted the automotive industry’s supply chain, causing production halts and delayed deliveries. Additionally, the ongoing COVID-19 pandemic and its related economic consequences have affected consumer demand and purchasing power.

Impact on Consumers: Prices and Availability

For consumers, the financial downturn at Stellantis may lead to increased vehicle prices due to the company’s efforts to offset its losses. Moreover, potential buyers might face longer wait times for their new vehicles as the company works to address its production backlog caused by the semiconductor shortage. However, the company has stated that it is taking steps to mitigate these issues and improve its supply chain resilience.

Impact on the World: Economic and Industry Consequences

The financial struggles of a major player like Stellantis can have far-reaching consequences. Economically, the decrease in earnings could potentially lead to job losses and reduced economic activity within the automotive industry and its related sectors. Furthermore, the ripple effect could influence related industries, such as automotive parts manufacturers and suppliers, as well as logistics and transportation services.

Stellantis’ Plan for Recovery

Despite the challenges, Stellantis remains optimistic about its future growth. The company plans to focus on cost-cutting measures, streamlining its operations, and investing in electrification and autonomous driving technologies. Additionally, Stellantis aims to leverage its diverse brand portfolio to cater to various market segments and geographies.

- Cost-cutting measures: Stellantis plans to reduce its fixed costs, optimize its manufacturing footprint, and improve its purchasing power.

- Streamlining operations: The company is working to simplify its organizational structure and improve its processes to enhance efficiency.

- Investing in electrification: Stellantis is committed to investing in electrification and plans to introduce more than 30 electrified models by 2025.

- Autonomous driving technologies: The company is collaborating with Waymo to develop autonomous driving technologies for its vehicles.

- Diverse brand portfolio: Stellantis’ diverse brand portfolio will enable it to cater to various market segments and geographies.

Conclusion

Stellantis, the multinational automobile manufacturing corporation, is navigating a challenging period following a significant decline in its 2024 earnings. The causes of this downturn include the global semiconductor shortage and the ongoing COVID-19 pandemic. Consumers may face increased vehicle prices and longer wait times, while the economic and industry consequences could be far-reaching. However, Stellantis remains optimistic about its future growth and plans to focus on cost-cutting measures, streamlining its operations, and investing in electrification and autonomous driving technologies. By leveraging its diverse brand portfolio, the company aims to cater to various market segments and geographies and return to growth in 2025.