Robinhood’s Q2 2021 Results and Future Growth: A Discussion Between Vlad Tenev and Jim Cramer

During the second quarter of 2021, Robinhood Markets, Inc., the revolutionary commission-free trading platform, reported impressive financial results. Robinhood Co-Founder, Chairman, and CEO Vlad Tenev sat down with Jim Cramer on CNBC’s Mad Money to discuss these results, the company’s premium offering, growth opportunities, and more.

Financial Highlights

In the Q2 2021 earnings call, Tenev shared that Robinhood had generated a revenue of $565 million, an increase of 143% compared to the same period last year. The company’s net income came in at $51 million, a significant improvement from the net loss of $1.4 billion in Q1 2021. The user base also grew to 21.3 million funded accounts, up from 18.3 million at the end of Q1 2021.

Robinhood Gold: Premium Offering

Tenev discussed the progress of Robinhood Gold, the company’s premium subscription service, which was launched in 2018. The service offers features like expanded hours for trading, level 2 market data, and access to research reports from major Wall Street firms. Tenev mentioned that there are now over 3 million Robinhood Gold subscribers, contributing approximately 25% of Robinhood’s total revenue.

Growth Opportunities

When asked about future growth opportunities, Tenev shared that Robinhood plans to expand its offerings beyond just equities trading. The company is exploring cryptocurrency, options trading, and other investment products. Additionally, Tenev mentioned that Robinhood aims to expand its presence in international markets, starting with the United Kingdom.

Impact on Individual Investors

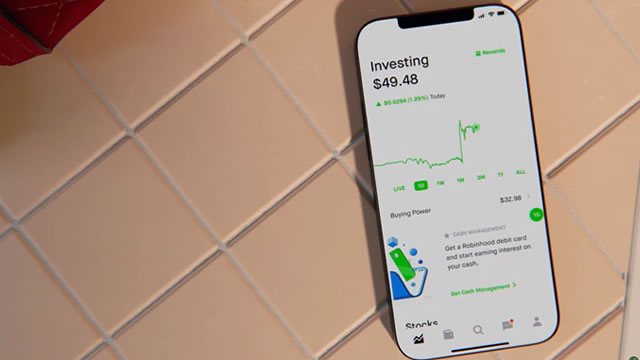

The success of Robinhood has been a game-changer for individual investors, providing a more accessible and affordable platform for trading stocks, ETFs, and cryptocurrencies. With its user-friendly interface and commission-free trades, Robinhood has attracted a younger demographic to the world of investing. The growth of Robinhood Gold and its premium features indicates a potential shift towards a subscription-based model for trading platforms, offering more value-added services to users.

Impact on the World

The rise of Robinhood and other commission-free trading platforms has disrupted the traditional brokerage industry. Established players like Charles Schwab and E-Trade have responded by lowering their commission rates to compete. This trend towards lower commissions has opened up investing to a wider audience, potentially leading to increased financial literacy and a more engaged investing public. Furthermore, the expansion of Robinhood into international markets could lead to a more globalized investment landscape.

In conclusion, Robinhood’s Q2 2021 results demonstrate the continued success of the company in disrupting the investing industry. With its user-friendly platform, innovative premium offerings, and international expansion plans, Robinhood is poised for further growth. The impact of Robinhood on individual investors and the world at large is significant, as it continues to make investing more accessible and affordable for a broader audience.

- Robinhood reported Q2 2021 revenue of $565 million, a 143% YoY increase.

- The company had 21.3 million funded accounts at the end of Q2 2021.

- There are now over 3 million Robinhood Gold subscribers, contributing 25% of Robinhood’s total revenue.

- Robinhood plans to expand beyond equities trading, offering cryptocurrency, options trading, and other investment products.

- The company aims to expand its presence in international markets, starting with the United Kingdom.

- Robinhood’s success has disrupted the traditional brokerage industry, leading to lower commission rates and increased financial literacy.