PG’s Growth Dynamics: Productivity Gains and Challenges

Pharmaceutical giant, PG, has been a trailblazer in driving growth through productivity and cost savings. By optimizing its operations and leveraging advanced technologies, the company has managed to outperform its peers and deliver consistent financial results. However, PG’s growth trajectory is not without challenges. In this post, we’ll explore the key drivers of PG’s growth and the headwinds it faces.

Productivity Gains

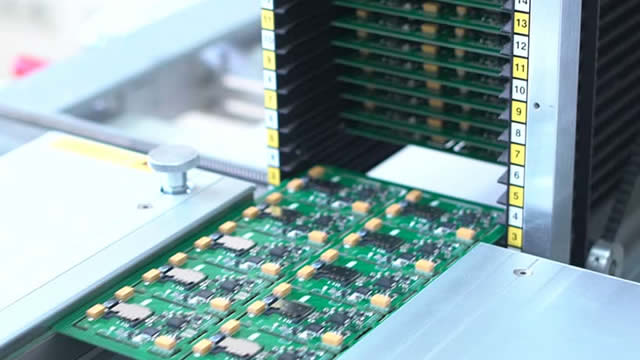

PG’s productivity gains can be attributed to several factors. First and foremost, the company has invested heavily in automation and digitalization. By implementing robotic process automation (RPA) and artificial intelligence (AI) in its manufacturing processes, PG has been able to streamline production, reduce errors, and improve efficiency. Moreover, the company has embraced lean manufacturing principles, which focus on eliminating waste and optimizing workflows.

Cost Savings

Cost savings have been another significant contributor to PG’s growth. The company has implemented various cost-cutting measures, including mergers and acquisitions, restructuring initiatives, and supply chain optimization. For instance, PG’s acquisition of Pfizer’s consumer healthcare business in 2019 expanded its product portfolio and provided economies of scale. Additionally, the company has focused on optimizing its supply chain by reducing inventory levels and improving logistics.

Headwinds

Despite these productivity gains and cost savings, PG faces several headwinds. Geopolitical tensions, currency volatility, and challenges in key markets are threatening the company’s growth prospects.

Geopolitical Tensions

Geopolitical tensions, particularly in the Middle East and Asia, pose a significant risk to PG’s operations. The ongoing conflict in Ukraine, for instance, has disrupted PG’s supply chain and increased costs. Additionally, tensions between the US and China have led to trade restrictions and tariffs, which have impacted PG’s ability to import raw materials and export finished products.

Currency Volatility

Currency volatility is another challenge for PG. The company operates in multiple countries and is exposed to currency risks. For instance, a strong US dollar can increase the cost of imported raw materials, while a weak euro can decrease the revenue generated from sales in Europe. PG has implemented hedging strategies to mitigate currency risks, but these strategies come with additional costs and complexity.

Challenges in Key Markets

Challenges in key markets, such as the US and Europe, are also threatening PG’s growth prospects. In the US, the patent cliff, which refers to the expiration of key drug patents, has led to increased competition and price pressure. In Europe, regulatory requirements and pricing pressures are making it difficult for PG to maintain profitability. Additionally, the ongoing COVID-19 pandemic has disrupted demand patterns and supply chains, adding to the uncertainty.

Impact on Consumers

The challenges facing PG are likely to have a ripple effect on consumers. Increased costs and decreased profitability could lead to higher prices for PG’s products. Moreover, supply chain disruptions could result in shortages or delays in the delivery of certain medications. It’s essential for consumers to stay informed about PG’s operations and be prepared for potential changes.

Impact on the World

PG’s challenges are not just limited to the pharmaceutical industry. The company’s operations are interconnected with various industries and economies. For instance, disruptions in PG’s supply chain could impact the availability and price of raw materials for other manufacturers. Additionally, currency volatility and geopolitical tensions could impact global trade and economic growth.

Conclusion

PG’s growth through productivity and cost savings has been impressive, but the company faces significant headwinds. Geopolitical tensions, currency volatility, and challenges in key markets are threatening PG’s growth prospects and could have far-reaching consequences. As consumers and stakeholders, it’s essential to stay informed about PG’s operations and be prepared for potential changes. The pharmaceutical industry and the world at large will be watching closely to see how PG navigates these challenges.

- PG’s growth through productivity and cost savings

- Geopolitical tensions as a headwind

- Currency volatility as a challenge

- Impact on consumers

- Impact on the world