The Recent Slump in Cryptocurrency Markets: A Closer Look at Aave (AAVE)

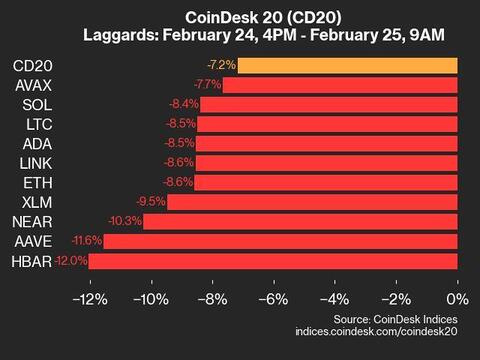

The cryptocurrency market has experienced significant volatility in recent days, with many popular tokens seeing double-digit percentage declines. Among the underperformers was Aave (AAVE), which declined by 11.6% from Monday. In this article, we’ll take a closer look at what might have contributed to this decline and discuss its potential implications.

Aave’s Recent Performance

Aave is a decentralized finance (DeFi) platform built on the Ethereum blockchain. It allows users to lend and borrow various cryptocurrencies in a trustless and decentralized manner. Aave’s native token, AAVE, serves as a governance token and is used to participate in the platform’s decision-making process.

Despite its innovative features and strong community, AAVE has struggled in the past few days. This decline can be attributed to a few factors. First, the broader cryptocurrency market has been experiencing sell-offs, with Bitcoin and Ethereum both seeing significant drops. This market-wide downturn has affected many cryptocurrencies, including AAVE.

Impact on Individual Investors

For individual investors holding AAVE, this decline could mean several things. First, they may be looking at paper losses if they bought AAVE at a higher price and are now selling at a lower one. However, it’s important to remember that cryptocurrencies are highly volatile and can rebound just as quickly as they decline. Long-term investors may choose to hold onto their AAVE, as the platform continues to grow and innovate.

Additionally, the decline in AAVE’s price could make it an attractive entry point for new investors. Those who believe in the potential of DeFi and AAVE specifically may see this as an opportunity to buy at a lower price. However, as with any investment, it’s important to do thorough research and consider the risks before making a decision.

Impact on the Wider World

The decline in AAVE’s price also has potential implications for the wider world of decentralized finance. As one of the leading DeFi platforms, AAVE plays a significant role in the ecosystem. Its decline could signal broader market uncertainty and potentially impact other DeFi projects. However, it’s important to remember that the cryptocurrency market is highly volatile and that short-term declines do not necessarily indicate long-term trends.

Additionally, the decline in AAVE’s price could make it more difficult for some users to access DeFi services. AAVE’s borrowing and lending platform relies on the value of AAVE to function properly. A decline in AAVE’s price could make it more difficult for some users to borrow or lend the cryptocurrencies they need. However, other DeFi platforms and stablecoins could help mitigate this issue.

Conclusion

The recent decline in AAVE’s price is a reminder of the volatility inherent in the cryptocurrency market. For individual investors, it could mean paper losses or an opportunity to buy at a lower price. For the wider world of decentralized finance, it could signal broader market uncertainty and impact other DeFi projects. However, it’s important to remember that the cryptocurrency market is highly volatile, and short-term declines do not necessarily indicate long-term trends. As always, thorough research and careful consideration are essential when making investment decisions.

- Aave (AAVE) is a decentralized finance (DeFi) platform built on the Ethereum blockchain.

- AAVE’s native token, AAVE, serves as a governance token and is used to participate in the platform’s decision-making process.

- The decline in AAVE’s price can be attributed to the broader cryptocurrency market sell-offs.

- Individual investors may be looking at paper losses or seeing this as an opportunity to buy at a lower price.

- The decline in AAVE’s price could impact other DeFi projects and make it more difficult for some users to access DeFi services.

- Thorough research and careful consideration are essential when making investment decisions in the cryptocurrency market.