Impact of U.S. Trade Policy on the Semiconductor Industry: A Closer Look

The semiconductor industry, a critical sector in the global technology value chain, recently faced a setback as a result of the U.S. President’s intention to impose tariffs on imported semiconductors. This decision, which came amidst a broader market downturn, caused a significant dip in the shares of chipmakers.

Background: U.S. Trade Policy and Semiconductors

The U.S. semiconductor industry is a significant contributor to the country’s economy, employing over 250,000 people and generating annual revenues of around $200 billion. However, the industry is heavily reliant on imported components, with approximately 85% of the semiconductors used in the U.S. being imported. The U.S. administration’s decision to impose tariffs on semiconductors, primarily from China, could potentially disrupt this supply chain and impact the industry’s profitability.

Impact on Chipmakers: Profitability Concerns and Market Volatility

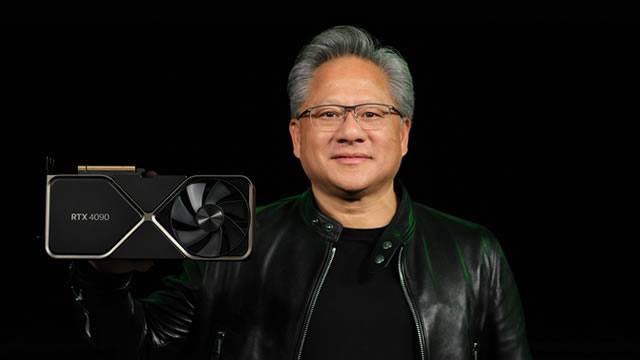

The U.S. chipmakers, including Intel, Qualcomm, and Advanced Micro Devices (AMD), experienced a decline in their shares following the U.S. President’s announcement. The potential tariffs could lead to increased production costs for these companies, as they may be forced to shift their manufacturing to domestic sources or pay the tariffs on imported components. This could, in turn, lead to lower profit margins and reduced competitiveness in the global market.

Impact on Consumers: Potential Price Increases and Delayed Product Launches

The tariffs could also have a ripple effect on consumers, with potential price increases for electronic devices containing semiconductors. These devices include computers, smartphones, and automobiles. Additionally, the tariffs could delay the launch of new products, as companies may face challenges in sourcing the necessary components from overseas.

Impact on the Global Economy: Trade Tensions and Geopolitical Risks

The decision to impose tariffs on semiconductors is part of a broader trend of increasing trade tensions between the U.S. and China. This could potentially lead to further geopolitical risks and instability in the global economy, as other industries and sectors become embroiled in the trade dispute. Furthermore, the semiconductor industry is a critical component of numerous sectors, including automotive, healthcare, and telecommunications, and any disruption to this industry could have far-reaching consequences.

Conclusion: Navigating the Complexities of Global Trade

The U.S. President’s intention to impose tariffs on imported semiconductors represents a significant challenge for the global semiconductor industry. The potential impact on chipmakers, consumers, and the global economy underscores the complexities of global trade and the need for a nuanced understanding of the various factors at play. As the situation evolves, it will be crucial for stakeholders to closely monitor developments and adapt to the changing landscape in order to minimize disruptions and maximize opportunities.

- U.S. President’s intention to impose tariffs on imported semiconductors

- Impact on chipmakers, including Intel, Qualcomm, and AMD

- Potential increase in production costs and reduced competitiveness for chipmakers

- Potential price increases for electronic devices containing semiconductors

- Delayed product launches for companies reliant on imported components

- Broader trend of increasing trade tensions between the U.S. and China

- Far-reaching consequences for industries reliant on semiconductors