Two Shining Stars in the Alternative Energy Sector: Clearway Energy (CWEN) and Bloom Energy (BE)

Hey there, curious investor! Today, we’re diving into the exciting world of alternative energy and comparing two stocks that have been making waves: Clearway Energy (CWEN) and Bloom Energy (BE). Let’s see which one offers a juicier return for value investors, shall we?

Clearway Energy (CWEN): The Powerhouse of Renewables

Clearway Energy is a leading independent power producer focusing on renewable, thermal, and energy infrastructure. They operate more than 10,000 megawatts of sustainable energy generation capacity, providing electricity to more than 8 million customers across North America. With a diverse portfolio of wind, solar, natural gas, and battery storage projects, CWEN is well-positioned to weather the ever-changing energy landscape.

Bloom Energy (BE): The Fuel Cell Pioneer

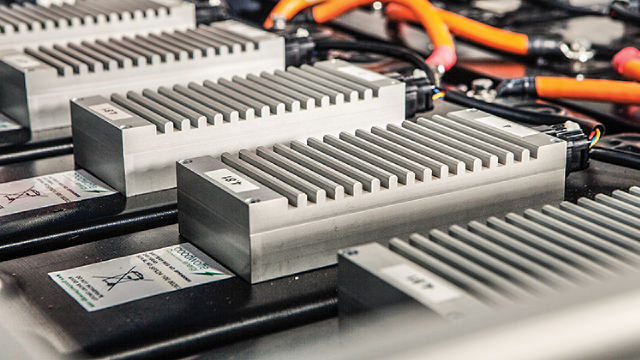

Bloom Energy is a Silicon Valley-based company that has revolutionized the energy industry with its Solid Oxide Fuel Cells (SOFCs). These fuel cells generate electricity from various fuels, including natural gas, renewable biogas, and even hydrogen. Bloom Energy’s innovative technology offers numerous benefits, such as on-site power generation, fuel flexibility, and reduced greenhouse gas emissions.

Comparing the Two: Valuation and Growth

Now, let’s discuss the nitty-gritty: which stock is a better buy for value investors? To answer that question, we’ll compare the two companies’ valuations and growth prospects.

- Clearway Energy (CWEN): With a market capitalization of around $11 billion, CWEN has a Price-to-Earnings (P/E) ratio of 12.6. The company’s revenue growth rate over the past five years has averaged 5.5%.

- Bloom Energy (BE): Bloom Energy has a market capitalization of approximately $6 billion and a P/E ratio of 8.3. The company’s revenue growth rate has averaged 18.3% over the past five years.

Based on these numbers, Bloom Energy seems to offer a more attractive valuation and growth rate for investors. However, it’s important to remember that past performance is not a guarantee of future results.

Impact on You and the World

Investing in either CWEN or BE can have a significant impact on your portfolio and the world. By choosing to invest in renewable energy, you’re contributing to a cleaner, more sustainable future. As the world transitions to renewable energy sources, companies like CWEN and BE will be at the forefront of this transformation. So, not only could you potentially earn a solid return on your investment, but you’ll also be making a difference.

On a personal level, investing in these companies can provide financial benefits, such as potential capital appreciation and dividend payments. Additionally, investing in companies that align with your values can be a source of pride and satisfaction.

On a global scale, the adoption of renewable energy sources will help reduce greenhouse gas emissions, combat climate change, and improve energy independence. In a world where energy demand continues to grow, investing in companies like CWEN and BE can help meet that demand in a sustainable way.

Conclusion

In conclusion, both Clearway Energy (CWEN) and Bloom Energy (BE) are compelling investments for those interested in the alternative energy sector. While they each have unique strengths, Bloom Energy currently offers a more attractive valuation and growth rate. However, it’s crucial to remember that investing always carries risk, and thorough research and due diligence are essential before making any investment decisions.

Ultimately, by investing in companies like CWEN and BE, you’re not only potentially earning a solid return on your investment but also contributing to a cleaner, more sustainable future. So, go ahead and make a difference – and maybe even a profit!

Now, it’s your turn! Which alternative energy stock do you think is a better buy, and why? Share your thoughts in the comments below!