An In-depth Analysis of Badger Meter, Inc. (BMI) Stock Performance

In the bustling world of stock markets, every trading session brings new developments and shifts in the value of various stocks. One such company that experienced a notable change in its stock price in the most recent session is Badger Meter, Inc. (BMI).

Badger Meter, Inc. (BMI) Stock Overview

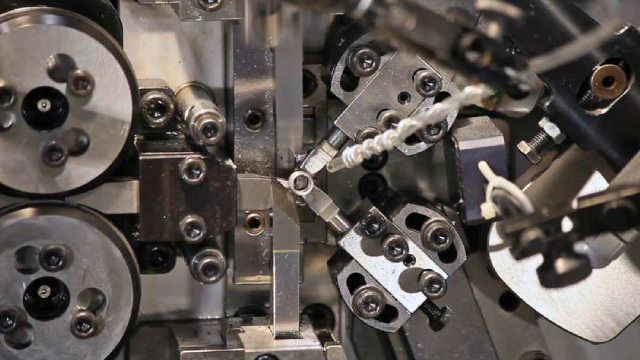

Badger Meter, Inc. is a leading global innovator and manufacturer of flow measurement and control products, instruments, and systems. The company’s offerings include flowmeters, tank gauging systems, and other related accessories. These products cater to various industries such as water, oil and gas, and industrial applications.

Recent Stock Performance

In the most recent trading session, Badger Meter, Inc. (BMI) closed at $206.21, marking a 1.92% decline from the previous trading day’s closing price of $210.78.

Impact on Individual Investors

For individual investors holding BMI stocks, this decline could mean a few things. If they bought the stock at a higher price and are looking to sell, they might be facing a loss. Conversely, those who were planning to buy and saw the dip as an opportunity might consider averaging down their position. It’s essential to remember that stock prices are influenced by various factors, and short-term fluctuations don’t always reflect the long-term potential of a company.

Impact on the Global Market

The ripple effect of BMI’s stock price change can be felt in broader markets as well. As an industry leader in flow measurement and control solutions, the company’s performance can indicate trends in the water, oil and gas, and industrial sectors. A decline in BMI’s stock price could potentially signal investor uncertainty in these industries, leading to a broader market reaction.

Factors Influencing the Stock Price

Several factors could have contributed to BMI’s recent stock price decline. These include:

- Economic conditions: A weak economy might lead to decreased demand for industrial products, including those manufactured by Badger Meter.

- Competition: Intense competition in the flow measurement and control market could put pressure on BMI’s margins and profits.

- Regulatory environment: Changes in regulations affecting the industries that BMI serves could impact the company’s revenue and profitability.

Looking Forward

While the recent stock price decline is a cause for concern, it’s crucial to remember that stock prices are influenced by a multitude of factors. Short-term fluctuations don’t always reflect the long-term potential of a company. As an investor, it’s essential to keep a long-term perspective and consider the company’s fundamentals, competitive position, and industry trends when evaluating its stock.

Conclusion

In conclusion, the recent decline in Badger Meter, Inc.’s (BMI) stock price is a noteworthy development that could impact both individual investors and the broader market. Understanding the factors influencing this change and maintaining a long-term perspective is crucial for making informed investment decisions. As always, it’s recommended to consult with a financial advisor for personalized advice based on your unique financial situation.