Buffet’s Cash Hoard: Awaiting the Next Big Downturn

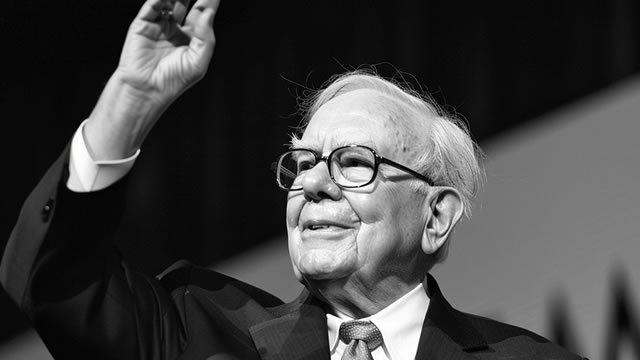

Warren Buffett, the legendary investor and chairman of Berkshire Hathaway, kept his cards close to his chest in his annual letter to shareholders over the weekend. However, his reluctance to deploy his growing cash hoard has become a topic of much discussion among value investors and market observers.

Buffett’s Cash Position

Buffett’s annual letter to shareholders is always an eagerly anticipated event in the financial world. This year, however, there was a noticeable absence of specific investment ideas or major acquisitions. Instead, Buffett focused on the importance of patience and value investing in uncertain times.

Buffett currently holds over $100 billion in cash, a significant portion of Berkshire Hathaway’s total assets. This is the largest cash position Buffett has held in over a decade. Some analysts believe that Buffett is waiting for a major downturn in the stock market before making any significant investments.

The Impact on Individual Investors

For individual investors, Buffett’s cautious approach could be a sign of things to come. Many market experts are predicting a potential market correction in the near future. If Buffett is indeed waiting for a downturn, it could be a good time for individual investors to consider following his lead and building up their cash positions.

- Consider diversifying your portfolio and building up your cash reserves

- Stay informed about market trends and economic indicators

- Be patient and avoid making hasty investment decisions

The Impact on the World

The potential impact of Buffett’s cash hoard on the world market is a topic of much debate. Some analysts believe that Buffett’s decision to hold onto his cash could signal a lack of confidence in the market and lead to further selling pressure. Others believe that Buffett’s cash could provide a much-needed injection of liquidity into the market during a downturn.

Regardless of the outcome, it’s clear that Buffett’s decision to hold onto his cash is a significant development in the world of investing. As one of the most influential investors in history, Buffett’s actions can have a ripple effect on the market and the economy as a whole.

Conclusion

Warren Buffett’s decision to hold onto his cash hoard is a sign of the uncertain times we live in. For individual investors, it could be a good time to consider building up their cash reserves and staying informed about market trends. For the world at large, Buffett’s actions could have significant implications for the market and the economy as a whole. Only time will tell what Buffett’s next move will be, but one thing is certain: he’s not one to make hasty decisions.

As investors, we can learn a valuable lesson from Buffett’s patient approach. In uncertain times, it’s important to stay informed, diversify our portfolios, and be patient. By following Buffett’s lead, we can weather the storms of the market and come out stronger on the other side.