Ethereum’s Recent Decline and Potential Rally: Insights from Cryptocurrency Market

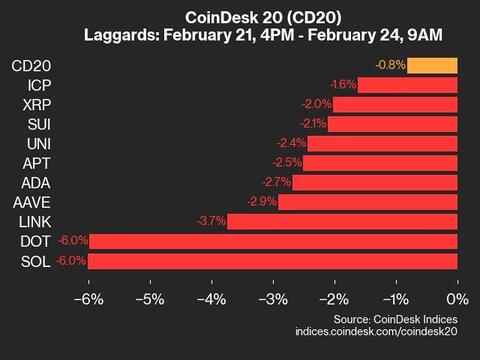

The cryptocurrency market has witnessed a significant shift over the past month, with Ethereum (ETH) experiencing a 19% decline. The second-largest cryptocurrency by market capitalization is currently trading at $2,683.09, with a market cap of $323.5 billion. This decline represents a 4.4% drop in the last 24 hours and a 3.1% decrease over the past week.

Historical Trends and Bank of Japan Rate Hikes

Analyst Benjamin Cowen, in a recent podcast, shared insights on Ethereum’s historical trend following Bank of Japan (BoJ) rate hikes. According to Cowen, Ethereum has shown a distinct pattern of experiencing a sharp wick within two weeks of a BoJ rate hike. This trend may suggest that Ethereum traders are positioning for a potential rally following the BoJ’s next rate decision.

Market Impact on Individual Investors

For individual investors, this trend could mean both opportunities and risks. On the one hand, those who have been holding Ethereum for a while and are confident in its long-term potential may consider this dip as a buying opportunity. On the other hand, new investors or those with a shorter investment horizon might find themselves in a dilemma, as the market volatility could lead to uncertainty and potential losses.

Global Implications

The impact of Ethereum’s price fluctuations extends beyond individual investors. Businesses that rely on Ethereum or other cryptocurrencies for transactions, such as DeFi platforms and NFT marketplaces, may experience increased volatility in their revenue streams. Furthermore, countries with significant investments in Ethereum or other cryptocurrencies might see their national economies affected by the market trends.

Conclusion

In conclusion, Ethereum’s recent decline and potential rally following BoJ rate hikes present both opportunities and challenges for individual investors and the global economy. As always, it’s essential to conduct thorough research before making any investment decisions and to stay informed about market trends and news. By staying up-to-date and maintaining a long-term perspective, investors can navigate the cryptocurrency market’s volatility and potentially reap the rewards.

- Ethereum has experienced a 19% decline over the past month, currently trading at $2,683.09 with a market cap of $323.5 billion.

- Historically, Ethereum shows a sharp wick within two weeks of a BoJ rate hike, suggesting potential for a rally.

- Individual investors may view this trend as a buying opportunity or face uncertainty and potential losses.

- Businesses relying on Ethereum for transactions may experience increased volatility in revenue streams.

- Staying informed and maintaining a long-term perspective is crucial for navigating the cryptocurrency market.