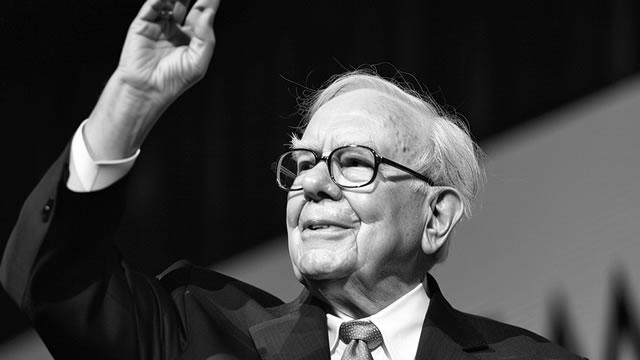

The Extraordinary Performance of Berkshire Hathaway under Warren Buffett’s Leadership

In 1965, Warren Buffett, the renowned investor and business magnate, took the reins of Berkshire Hathaway (BRK.A and BRK.B). At the time, the textile manufacturing company was far from the powerhouse it would become. However, Buffett’s strategic vision and investment acumen soon transformed Berkshire Hathaway into a multinational conglomerate, renowned for its diverse portfolio of businesses and exceptional financial performance.

Buffett’s Turnaround of Berkshire Hathaway

Buffett’s acquisition of Berkshire Hathaway was not a typical investment move. He saw potential in the undervalued textile business and believed he could revitalize it. Over the years, he made several strategic acquisitions, including Burlington Industries and Fruit of the Loom, expanding Berkshire Hathaway’s offerings beyond textiles. Buffett also began acquiring public companies, such as See’s Candies, Coca-Cola, and The Washington Post, further diversifying the conglomerate’s holdings.

Outstanding Financial Performance

Buffett’s leadership has yielded remarkable results for Berkshire Hathaway’s shareholders. Since 1965, the company’s stock has compounded at an annual rate of 19.9% – significantly outperforming the broader market. In comparison, the S&P 500 has compounded at an annual rate of 10.4% during the same period.

Impact on Individual Investors

For individual investors, Berkshire Hathaway’s impressive performance serves as a testament to the power of long-term investment strategies and the value of having a visionary leader at the helm. Buffett’s approach to investing – focusing on undervalued companies with strong fundamentals – has become a widely adopted strategy among investors. By following his lead and maintaining a long-term perspective, investors can potentially achieve impressive returns.

Impact on the World

Beyond the financial realm, Berkshire Hathaway’s success under Buffett has influenced the business world in numerous ways. The company’s acquisitions have led to the growth and expansion of various industries, creating jobs and contributing to economic growth. Additionally, Buffett’s philanthropic efforts, such as the Giving Pledge, have inspired other wealthy individuals to pledge to donate the majority of their wealth to charitable causes, further impacting communities around the world.

Conclusion

Warren Buffett’s acquisition of Berkshire Hathaway in 1965 marked the beginning of an extraordinary journey for both the company and its shareholders. Buffett’s strategic vision and investment acumen transformed a struggling textile manufacturer into a multinational conglomerate that has consistently outperformed the broader market. The lessons from Berkshire Hathaway’s success – the importance of long-term investment strategies and having a visionary leader – continue to resonate with investors today. Furthermore, the company’s impact on industries, economic growth, and philanthropy serves as a reminder of the far-reaching influence of successful businesses and their leaders.

- Buffett acquired Berkshire Hathaway in 1965, transforming it into a multinational conglomerate

- Berkshire Hathaway’s stock has compounded at 19.9% annually since 1965, outperforming the S&P 500

- Buffett’s investment strategies and long-term perspective have inspired individual investors

- Berkshire Hathaway’s acquisitions have contributed to industry growth and job creation

- Buffett’s philanthropic efforts, such as the Giving Pledge, have inspired others to give back