ASML’s Potential Revenue Decline: Six Scenarios Amidst China Trade Restrictions

ASML, a leading global supplier of photolithography equipment for the semiconductor industry, has recently faced potential trade restrictions expansion towards China for its DUV (Deep Ultraviolet) machines. This situation has raised concerns regarding the company’s financial health and the impact on the semiconductor industry as a whole.

Background

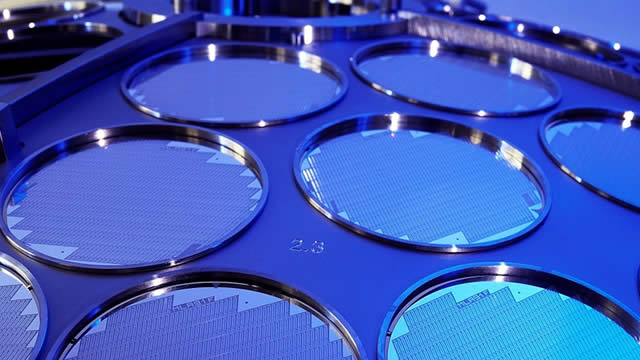

ASML’s DUV machines are crucial components in the manufacturing process of semiconductors, enabling the creation of increasingly smaller and more complex chips. China is a significant market for ASML, accounting for approximately 20% of the company’s revenue. However, recent tensions between the US and China have led to potential trade restrictions, which could significantly impact ASML’s financial performance.

Six Scenarios

To assess the potential impact of these trade restrictions on ASML’s revenue, six scenarios have been analyzed:

- Bear Case: The trade restrictions remain in place, and ASML is unable to sell any DUV machines to China. In this scenario, the company’s revenue could decline by up to 27%.

- Base Case: The trade restrictions remain in place, but ASML manages to secure alternative markets to offset the loss of revenue from China. This could result in a more modest revenue decline.

- Bull Case: The trade restrictions are lifted, and ASML continues to sell DUV machines to China. In this scenario, the company’s revenue could remain relatively stable.

- Scenario 1 (No China Revenue – Bear Case): ASML is unable to sell any DUV machines to China, but manages to secure alternative markets. In this scenario, the company’s revenue could still decline significantly, but not as drastically as in the Bear Case.

- Scenario 2 (No China Revenue – Base Case): ASML is unable to sell any DUV machines to China, but manages to secure alternative markets and maintain its current market share. In this scenario, the company’s revenue could remain stable, but the profitability may be impacted.

- Scenario 3 (No China Revenue – Bull Case): ASML is unable to sell any DUV machines to China, but manages to secure alternative markets and expand its market share. In this scenario, the company’s revenue could even increase, as it would need to focus on expanding its presence in other markets.

Even when anticipating no future business in China, ASML’s current stock price remains within the fair value range, according to various financial analysts. This indicates that the market has already priced in the potential negative impact of the trade restrictions.

Impact on You

For individual investors, the potential revenue decline of ASML could impact their portfolio’s performance. Depending on the scenario, the stock price could experience volatility, with potential for both gains and losses. It is essential to closely monitor the situation and consider diversifying your portfolio to mitigate risk.

Impact on the World

The potential revenue decline of ASML could have ripple effects on the semiconductor industry and the global economy. A significant decline in ASML’s revenue could lead to supply chain disruptions, as well as potential price increases for semiconductors. It could also impact other companies in the semiconductor value chain, such as equipment suppliers and manufacturers.

Conclusion

The potential trade restrictions on ASML’s DUV machines in China could have a significant impact on the company’s financial performance. Six scenarios have been analyzed to assess the potential revenue decline, taking into account various market conditions. Even when anticipating no future business in China, ASML’s current stock price remains within the fair value range. It is crucial for investors to closely monitor the situation and consider the potential impact on their portfolios and the broader semiconductor industry.

The potential revenue decline of ASML could also have broader implications for the global economy, with potential supply chain disruptions and potential price increases for semiconductors. It is essential to stay informed about the situation and consider the potential impact on your investments and the world around you.