Marvell Technology: A Leading Player in Advanced Chips for Data Centers

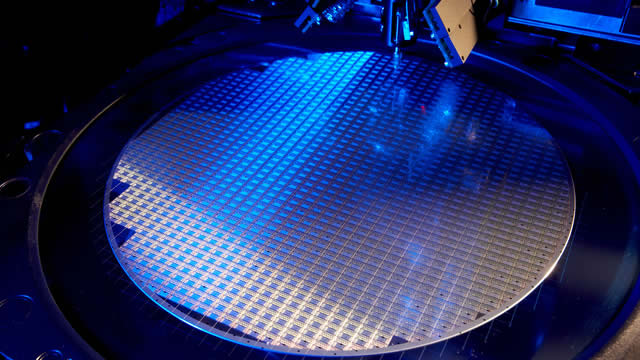

Marvell Technology Group Ltd. is a global semiconductor company that has made significant strides in designing and manufacturing advanced chips for data centers. With a strong focus on innovation and performance, Marvell has been at the forefront of the industry, leading the way in the development of 2nm and 3nm chips. These chips are essential components in powering the digital transformation of businesses and organizations, enabling them to process large amounts of data efficiently and effectively.

Marvell’s Data Center Performance

Marvell’s data center business has been a major contributor to the company’s revenue growth in recent years. The demand for data center infrastructure has been surging due to the increasing adoption of cloud services and the growing importance of data in business operations. Marvell’s advanced chips have been well-received in this market, helping the company to establish a strong presence.

Declining Revenues from Other Sectors

However, Marvell’s overall growth has been impacted by declining revenues from other sectors, particularly cellular infrastructure. The company has been facing intense competition in this market, with competitors offering similar products at lower prices. This has led to a decline in revenues for Marvell, which has weighed on the company’s overall financial performance.

Valuation Concerns

Despite Marvell’s strong data center performance, the company’s current valuation appears significantly overvalued based on a discounted cash flow (DCF) model. This suggests caution for investors, who may be hesitant to invest in the stock at its current price.

Impact on Individuals

For individuals who are investors in Marvell Technology, the company’s declining revenues from other sectors and overvalued valuation may be a cause for concern. It is important for investors to carefully consider their investment strategy and risk tolerance when investing in any stock, especially one with significant challenges in certain markets.

Impact on the World

Marvell’s challenges in the cellular infrastructure market and overvalued valuation may have broader implications for the semiconductor industry as a whole. The industry is facing increased competition and pressure to innovate in order to stay competitive. This could lead to consolidation and mergers and acquisitions as companies look to strengthen their positions in key markets.

Conclusion

Marvell Technology’s leadership in designing advanced chips for data centers has positioned the company well for the future, but its challenges in other sectors and overvalued valuation present risks for investors. Individuals and the broader semiconductor industry will be watching Marvell closely as it navigates these challenges and seeks to grow in new markets.

- Marvell Technology is a leading player in designing advanced chips for data centers

- Company’s data center business has been a major contributor to revenue growth

- Declining revenues from other sectors, particularly cellular infrastructure

- Current valuation appears overvalued based on a DCF model

- Impact on individuals: investors should consider investment strategy and risk tolerance

- Impact on the world: consolidation and M&A possible in the semiconductor industry