ASML’s Leadership in Semiconductor Manufacturing Equipment: A Cautious Approach

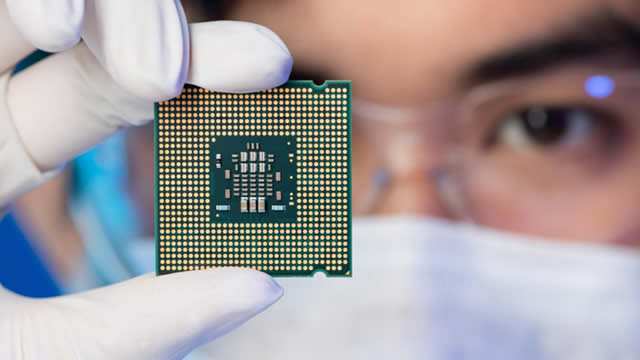

ASML Holding NV, a Dutch company, is currently the undisputed leader in the production of semiconductor manufacturing equipment. Their systems are utilized by major tech giants and semiconductor manufacturers worldwide to create the intricate patterns and structures on silicon wafers, which form the foundation for integrated circuits. However, despite this impressive market position, it is crucial to approach ASML’s stock with caution.

Geopolitical Risks

Geopolitical tensions pose a significant risk to ASML’s business. The ongoing trade dispute between the United States and China, for instance, could lead to restrictions on the export of semiconductor manufacturing equipment from the Netherlands to China. Such restrictions could negatively impact ASML’s revenue and earnings, as China is a major market for the company.

Premium Valuation

Another reason for a cautious approach is ASML’s premium valuation. The company’s stock trades at a significant multiple to its earnings and revenue, making it an expensive investment relative to its peers. This high valuation could make ASML’s stock vulnerable to a correction if investor sentiment shifts, leading to a sell-off and potential price decline.

Impact on Individuals

For individual investors, a cautious approach to ASML’s stock is advised due to the geopolitical risks and premium valuation. If you already own ASML shares, it may be prudent to consider diversifying your portfolio by investing in other sectors or companies. Potential investors should carefully weigh the risks and potential rewards before deciding to purchase ASML stock.

Impact on the World

The potential impact of ASML’s situation on the world extends beyond its shareholders. The semiconductor industry is a crucial component of numerous sectors, including technology, automotive, healthcare, and telecommunications. Any disruption to ASML’s business could have ripple effects, potentially leading to delays in product releases, increased costs, and decreased competitiveness for companies reliant on their equipment.

Conclusion

ASML’s leadership in semiconductor manufacturing equipment is undeniable, but investors must approach the company’s stock with caution due to geopolitical risks and a premium valuation. Individual investors should consider diversifying their portfolios, while potential investors should carefully evaluate the risks and potential rewards. The potential impact on the world extends beyond ASML’s shareholders, as disruptions to the company’s business could have far-reaching consequences.

- ASML is the leading provider of semiconductor manufacturing equipment.

- Geopolitical tensions pose a significant risk to the company’s business.

- ASML’s stock trades at a premium valuation.

- Individual investors should consider diversifying their portfolios.

- Potential investors should carefully evaluate the risks and potential rewards.

- Disruptions to ASML’s business could have far-reaching consequences.