ASML: The Unstoppable Force in the Semiconductor Industry

ASML Holding NV, a Dutch company, has been making waves in the semiconductor industry with its market dominance, unique Extreme Ultraviolet (EUV) lithography technology, and robust financial health. In this blog post, we’ll delve deeper into ASML’s competitive edge, its strategic partnerships, and the impact of geopolitical risks and growth catalysts on its future.

ASML’s Competitive Advantage

ASML’s competitive advantage is built on three pillars:

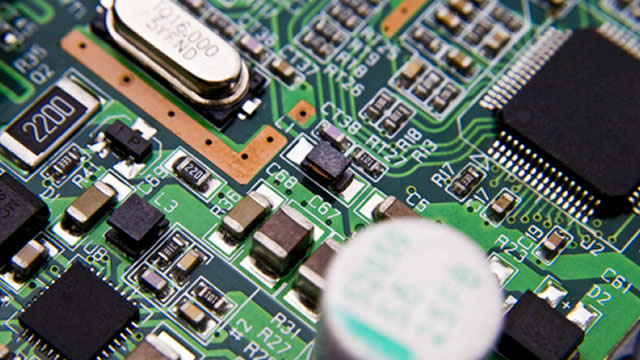

- Advanced Lithography Systems: ASML’s lithography systems are the gold standard in the semiconductor industry. Lithography is the process of transferring patterns onto a silicon wafer, which forms the basis of integrated circuits. ASML’s EUV lithography technology sets it apart from competitors, enabling the production of smaller, faster, and more power-efficient chips.

- Significant R&D Investment: ASML invests heavily in research and development, ensuring it stays at the forefront of technological innovation. In 2021, the company spent €6.8 billion on R&D, accounting for 23% of its revenue. This investment not only keeps ASML competitive but also drives future growth.

- Strategic Partnerships: ASML has formed strategic partnerships with leading chipmakers like Taiwan Semiconductor Manufacturing Company (TSMC), Samsung, and Intel. These partnerships provide ASML with a steady stream of customers and a deep understanding of the chipmakers’ needs, enabling it to tailor its technology to their requirements.

Geopolitical Risks and Their Impact

Despite the strong position of ASML, geopolitical risks remain. The ongoing tensions between the US and China could result in trade restrictions, affecting ASML’s ability to sell its lithography systems to Chinese chipmakers. Additionally, the US’s CHIPS Act, which aims to boost the domestic semiconductor industry, could incentivize US companies to reduce their reliance on foreign suppliers like ASML.

However, these risks are mitigated by ASML’s market position and technological barriers. ASML’s EUV lithography technology is not easily replicable, giving it a significant competitive edge. Furthermore, the semiconductor industry is highly interconnected, making it difficult for any single country to become self-sufficient. ASML’s strategic partnerships with major chipmakers also provide a degree of protection against geopolitical risks.

Impact on Individuals and the World

The advancements in semiconductor technology driven by companies like ASML have a profound impact on individuals and the world. These technologies power the devices we use daily, from smartphones to laptops and smart TVs. They enable the Internet of Things (IoT) and the development of autonomous vehicles, smart cities, and advanced healthcare systems.

For individuals, these advancements translate into increased productivity, improved communication, and enhanced entertainment. For the world, they contribute to economic growth, job creation, and a more interconnected and efficient society. However, they also raise concerns about privacy, security, and the digital divide, highlighting the need for responsible innovation and equitable access to technology.

Conclusion

ASML’s market dominance, unique EUV lithography technology, and strong financial health make it an attractive investment opportunity, with potential for double-digit upside over the next three years. Its competitive advantage is built on advanced lithography systems, significant R&D investment, and strategic partnerships with top chipmakers. Despite geopolitical risks, ASML’s market position and technological barriers ensure its MOAT remains intact, with growth catalysts like AI and western subsidies driving future demand.

The impact of ASML’s advancements extends beyond the semiconductor industry, touching individuals and the world in profound ways. As we continue to innovate and push the boundaries of technology, it’s essential to consider both the opportunities and challenges that come with it.