MACD and Bollinger Bands for Crypto Trading

Understanding MACD and Bollinger Bands

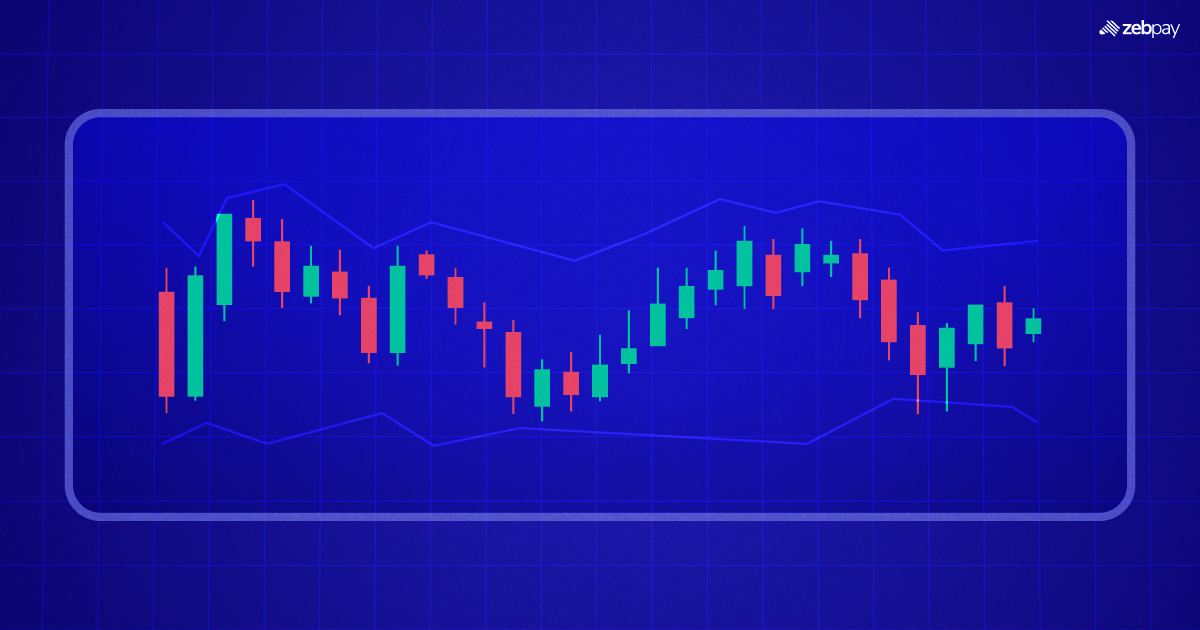

MACD and Bollinger Bands are two powerful tools that can be combined to analyze and provide trading information about crypto markets. The combination of these tools allows for a more detailed analysis of markets, and to predict the future direction of crypto markets movement.

MACD, which stands for Moving Average Convergence Divergence, is a momentum indicator that shows the relationship between two moving averages of a security’s price. It is best used as a trend-identification tool, as well as a signal for buying and selling cryptocurrencies.

Bollinger Bands, on the other hand, are volatility bands placed above and below a moving average. They are used to measure the volatility of a cryptocurrency, as well as to determine the overbought or oversold conditions of the market.

Combining MACD and Bollinger Bands

When combining MACD and Bollinger Bands, traders can benefit from a more comprehensive analysis of the crypto market. By using the momentum and trend-identification capabilities of MACD, along with the volatility measurement of Bollinger Bands, traders can make more informed decisions about when to buy or sell cryptocurrencies.

For example, when the MACD line crosses above the signal line, and the price of the cryptocurrency is touching the upper Bollinger Band, it may indicate that the market is overbought and a reversal is imminent. On the other hand, when the MACD line crosses below the signal line, and the price is touching the lower Bollinger Band, it may signal that the market is oversold and a potential buying opportunity.

Effect on Individuals

For individual traders, combining MACD and Bollinger Bands can provide a more structured approach to crypto trading. By using these tools together, traders can gain a better understanding of market trends and make more informed decisions about buying and selling cryptocurrencies. This can lead to more profitable trades and improved trading strategies.

Effect on the World

On a larger scale, the combination of MACD and Bollinger Bands in crypto trading can impact the overall crypto market by providing more accurate and timely information to traders. This can result in more stable and efficient trading, as well as increased liquidity and market participation. In the long run, it can lead to a more mature and transparent crypto market that is beneficial for all participants.

Conclusion

Combining MACD and Bollinger Bands for effective trading in the crypto market can provide traders with valuable insights and information to make better trading decisions. By understanding the momentum and volatility of the market, traders can improve their trading strategies and overall profitability. This combination of tools not only benefits individual traders but also contributes to a more efficient and mature crypto market.