Premarket Trading: Major Chip Stocks Show Ambivalent Reactions

As the market opens on Friday, the major chip stocks are demonstrating a mixed response to the current market conditions. Although the overall trend is positive, these companies are still seeking a catalyst to drive significant growth.

Positive Market Conditions

The tech sector, which includes chip stocks, has been one of the best-performing sectors in the market recently. The sector has been boosted by strong earnings reports from major tech companies and optimism about the economic recovery. Additionally, the Federal Reserve’s decision to keep interest rates low has made tech stocks more attractive to investors.

Seeking a Catalyst

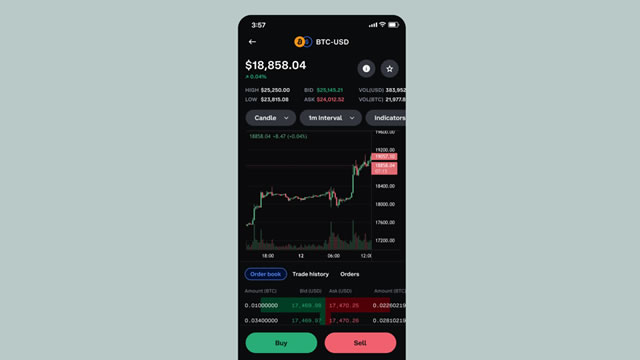

Despite these positive conditions, chip stocks are not yet showing the same level of enthusiasm. Intel (INTC), for example, is up only slightly in premarket trading, while Advanced Micro Devices (AMD) and NVIDIA (NVDA) are both down slightly. These companies are looking for a catalyst to drive growth, such as a surge in demand for their products or a major announcement from a key customer.

Impact on Individuals

For individual investors, the ambivalent reaction from chip stocks may create an opportunity to buy at a lower price before the market rallies. However, it is important to do thorough research before making any investment decisions. Consider the financial health of the company, its competitive position in the market, and the overall economic conditions.

Impact on the World

The impact of chip stocks on the world is significant, as these companies are key players in the tech industry and drive innovation in areas such as artificial intelligence, cloud computing, and autonomous vehicles. A strong performance from chip stocks can boost the overall tech sector and contribute to economic growth. Conversely, a weak performance can dampen investor sentiment and undermine confidence in the tech industry.

Conclusion

The major chip stocks are showing ambivalent reactions to the market conditions on Friday, as they seek a catalyst to drive growth despite overall positive trends. For individual investors, this may present an opportunity to buy at a lower price before the market rallies. However, it is important to do thorough research before making any investment decisions. The impact of chip stocks on the world is significant, as they drive innovation and contribute to economic growth. Stay informed about the latest developments in the tech sector to make informed investment decisions and stay ahead of the curve.

- Intel (INTC): Up slightly in premarket trading

- Advanced Micro Devices (AMD): Down slightly in premarket trading

- NVIDIA (NVDA): Down slightly in premarket trading