Ethereum Price Dips Following Large-Scale Cryptocurrency Exchange Hack

In the ever-volatile world of cryptocurrencies, another significant event has shaken the market. Ethereum (ETH), the second-largest digital currency by market capitalization, has experienced a 4% decline within the past 24 hours, trading below $2,650 at press time. This downward trend can be attributed to a security breach that occurred at the popular cryptocurrency exchange, Bybit.

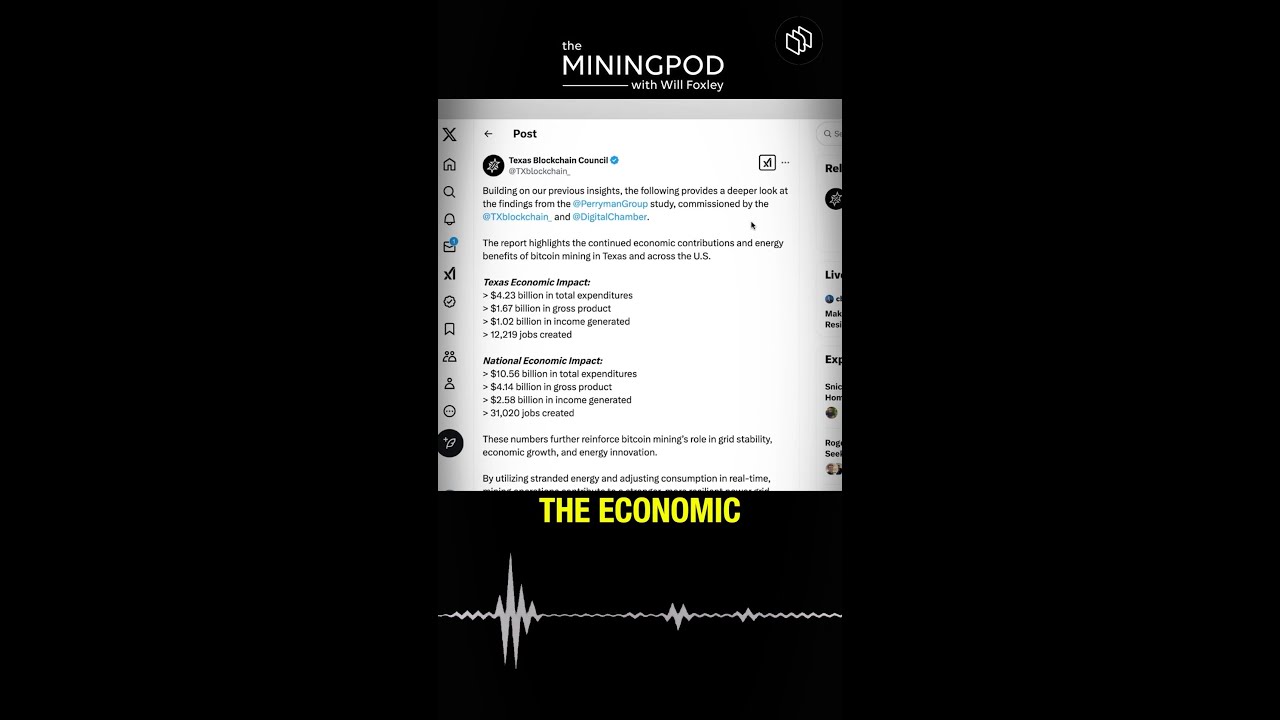

Bybit Confirms Unauthorized Transfer of 401,347 ETH

Bybit, a leading cryptocurrency derivatives exchange, has reported an unauthorized transfer of approximately 401,347 ETH, valued at a staggering $1.12 billion at the time of the incident. The exchange acknowledged the breach in a statement, assuring its users that they will be fully compensated for any losses incurred.

Impact on Ethereum Price

The news of the security breach at Bybit sent shockwaves through the cryptocurrency market, leading to a sell-off of Ethereum and other digital assets. The fear of potential further security concerns and the uncertainty surrounding the stolen funds weighed heavily on investor sentiment, causing the Ethereum price to plummet.

Effect on Individual Investors

For individual investors, this event serves as a stark reminder of the risks associated with cryptocurrency investing. The sudden price drop may lead to losses for those who hold Ethereum or other digital currencies. Moreover, it could discourage new investors from entering the market due to heightened concerns over security and the potential for future hacks.

Impact on the Global Cryptocurrency Market and Beyond

The hack at Bybit is not just a concern for Ethereum investors but for the entire cryptocurrency market. As the second-largest cryptocurrency by market capitalization, Ethereum’s price fluctuations can significantly impact the broader market. Furthermore, this incident may also raise questions about the security measures of other cryptocurrency exchanges and the regulatory landscape surrounding digital currencies.

Possible Regulatory Response

Regulators around the world have been closely monitoring the cryptocurrency market for signs of fraudulent activity and security breaches. The recent hack at Bybit may prompt further regulatory scrutiny and potential new regulations aimed at enhancing security and investor protection in the burgeoning digital currency industry.

Conclusion

The security breach at Bybit and the subsequent dip in Ethereum’s price serve as a reminder of the inherent risks and volatility of the cryptocurrency market. While individual investors may experience losses, the broader implications of this event extend beyond the digital currency market. The response from regulators and the cryptocurrency industry as a whole will be crucial in shaping the future of this innovative yet uncertain sector.

- Ethereum price declines 4% in 24 hours

- Bybit reports unauthorized transfer of 401,347 ETH

- Individual investors may experience losses

- Regulatory response to be closely watched