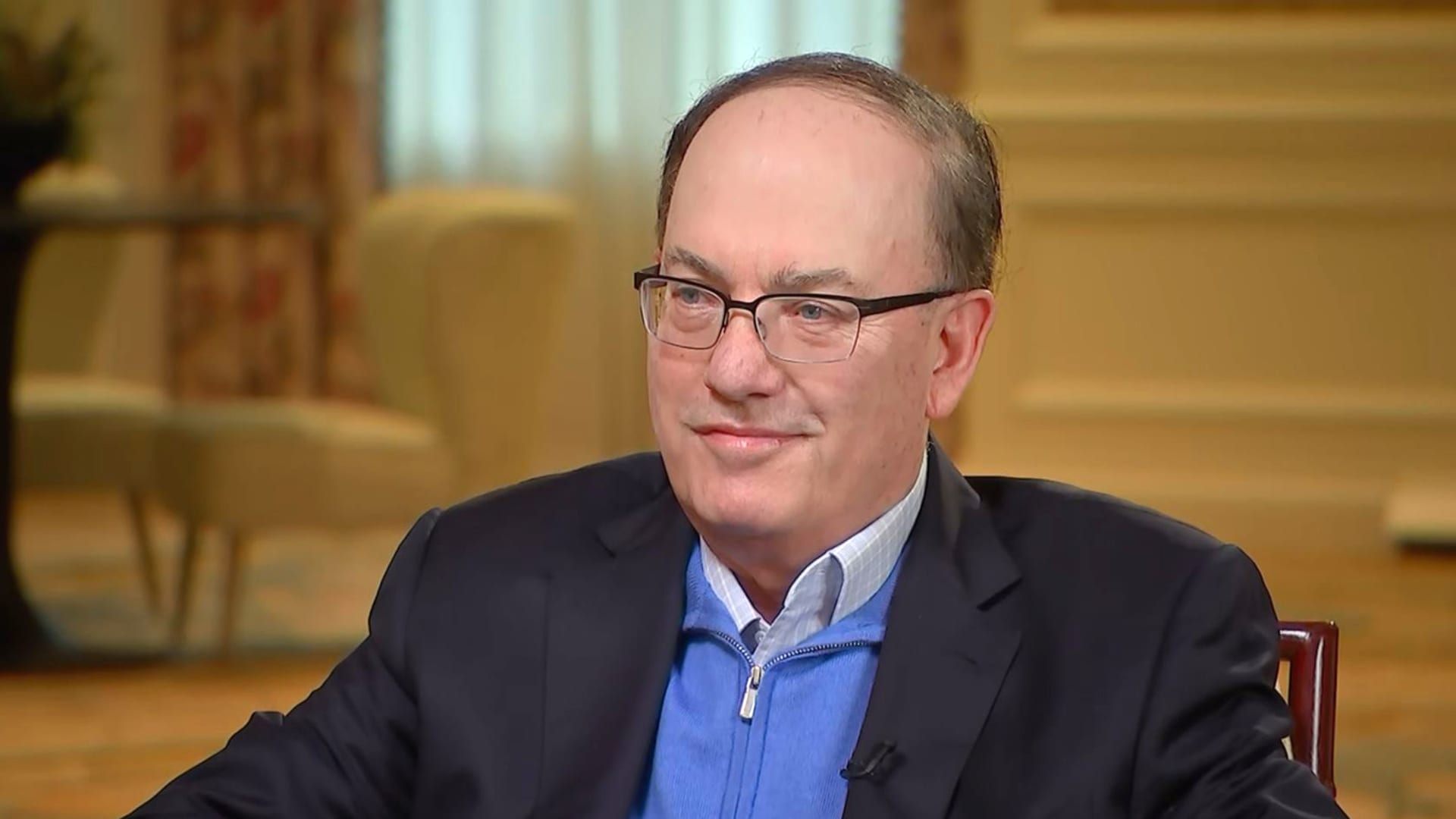

Point72’s Chairman and CEO Goes Bearish: Trump’s Trade Policy and Its Implications

In a recent interview, Steve Cohen, the chairman and CEO of hedge fund Point72, shared his concerns about the economic impact of President Donald Trump’s aggressive trade policies. This marks a shift in Cohen’s stance, as he had previously expressed a bullish outlook.

Inflationary Pressures

One of Cohen’s major worries is the potential for inflationary pressures. The ongoing trade tensions between the United States and its major trading partners, such as China and Europe, have led to increased tariffs on various goods. This can result in higher production costs for businesses, which may, in turn, lead to higher prices for consumers.

Lower Consumer Spending

Another concern for Cohen is the potential for lower consumer spending. The uncertainty caused by the trade disputes can lead to reduced consumer confidence, as individuals and businesses may be hesitant to make large purchases due to the potential for increased costs. This can have a ripple effect on the economy, leading to slower growth.

Impact on Individuals

For individuals, the trade tensions could lead to higher prices for certain goods, particularly those that are heavily imported. This could put a strain on household budgets, especially for those living paycheck to paycheck. Additionally, lower consumer confidence could lead to fewer job opportunities and slower wage growth.

- Higher prices for imported goods

- Strain on household budgets

- Lower consumer confidence

- Fewer job opportunities

- Slower wage growth

Impact on the World

The trade tensions could also have significant implications for the global economy. If other countries retaliate with their own tariffs, it could lead to a full-blown trade war. This could disrupt global supply chains, leading to slower economic growth and increased volatility in financial markets.

- Potential for a full-blown trade war

- Disruption of global supply chains

- Slower economic growth

- Increased volatility in financial markets

Conclusion

Steve Cohen’s shift to a bearish outlook underscores the potential risks of President Trump’s aggressive trade policies. The uncertainty caused by the ongoing trade disputes could lead to higher prices for consumers, lower consumer confidence, and slower economic growth. It is important for individuals to stay informed about these developments and to consider how they may be impacted. At the same time, policymakers must work to find a resolution to the trade tensions, as the potential consequences could be far-reaching and long-lasting.

The trade tensions could also have significant implications for the global economy. If other countries retaliate with their own tariffs, it could lead to a full-blown trade war, disrupting global supply chains and increasing volatility in financial markets. It is crucial that all parties involved work towards finding a peaceful resolution, as the potential consequences could be dire.