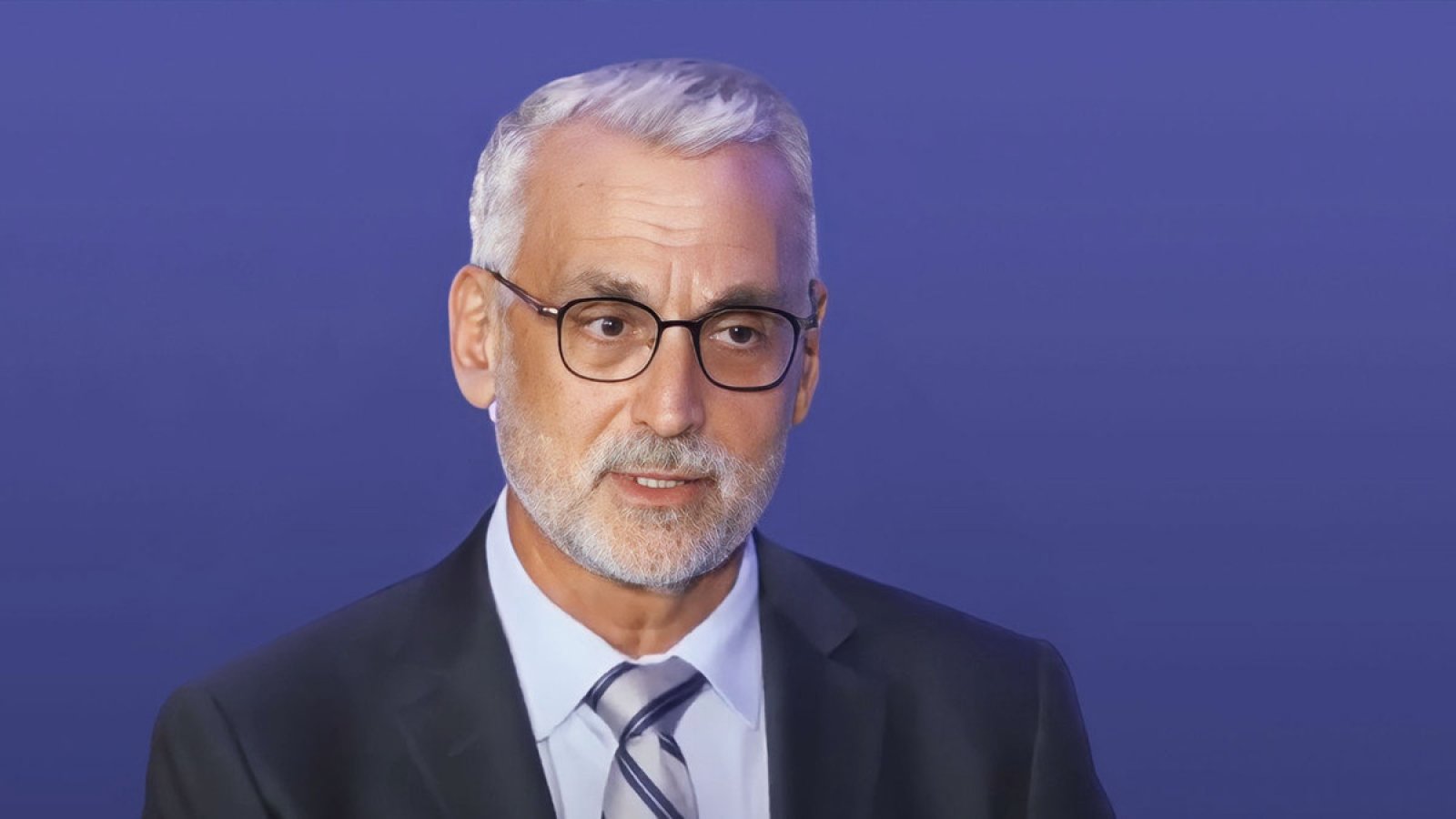

Stuart Alderoty Speaks Out Against SEC’s “Follow-On” Actions

Introduction

Stuart Alderoty, the chief legal officer at enterprise blockchain Ripple, recently made a bold statement regarding the SEC’s practices. He pointed out that the SEC’s habit of filing “follow-on” actions after the DOJ is a major source of waste at the agency. This revelation has sparked discussions within the legal and financial communities about the implications of such practices.

The SEC’s “Follow-On” Actions

According to Alderoty, the SEC’s tendency to file “follow-on” actions after the Department of Justice (DOJ) has already taken legal action is not only redundant but also a significant waste of resources. These actions, which are often seen as unnecessary, prolong legal proceedings and result in increased costs for both the agency and the entities involved.

One of the key issues with these “follow-on” actions is that they can create uncertainty in the legal landscape. Companies that are already facing legal challenges from the DOJ may find themselves in a difficult position when the SEC decides to pursue additional actions. This can lead to prolonged legal battles, increased costs, and a lack of clarity for all parties involved.

The Impact on Businesses

For businesses, the SEC’s “follow-on” actions can have serious consequences. Not only do these actions create additional legal challenges and expenses, but they also create uncertainty for companies operating in regulated industries. The need to continuously defend against regulatory actions can drain resources and divert attention away from core business operations.

Furthermore, the prolonged legal battles resulting from these actions can damage a company’s reputation and erode investor confidence. As such, it is crucial for businesses to stay informed and prepared to navigate the legal complexities that may arise from the SEC’s practices.

The Global Implications

On a global scale, the SEC’s “follow-on” actions can have far-reaching implications. As one of the leading regulatory bodies in the world, the SEC sets a precedent that is followed by other agencies and organizations. Therefore, the agency’s practices can influence how legal actions are pursued and resolved in other countries.

Additionally, the SEC’s actions can impact global financial markets and regulatory frameworks. Companies operating internationally may find themselves facing legal challenges in multiple jurisdictions as a result of the SEC’s practices. This can create a complex legal landscape that requires careful navigation and strategic planning.

Conclusion

Stuart Alderoty’s comments regarding the SEC’s “follow-on” actions shed light on the challenges and inefficiencies within the agency’s practices. As businesses and individuals navigate the complexities of the legal landscape, it is important to stay informed and prepared to address the implications of regulatory actions. By understanding the impact of these practices, stakeholders can better advocate for transparency, efficiency, and fairness in regulatory proceedings.

How This Will Affect You

The SEC’s habit of filing “follow-on” actions after the DOJ can potentially impact individuals and businesses involved in legal proceedings with regulatory bodies. The increased costs and uncertainties resulting from these actions may require you to allocate additional resources and be prepared for prolonged legal battles. It is important to stay informed and seek legal counsel to navigate these challenges effectively.

How This Will Affect the World

The SEC’s practices regarding “follow-on” actions can influence global regulatory frameworks and legal standards. As a leading regulatory body, the SEC’s actions set a precedent that may be followed by other agencies worldwide. This can impact how businesses operate internationally and navigate legal challenges in different jurisdictions. It is crucial for global stakeholders to monitor these developments and advocate for fair and efficient regulatory practices.