The Chicago Mercantile Exchange Bitcoin Futures Open Interest Falls as Year-End Approaches

Quick Take

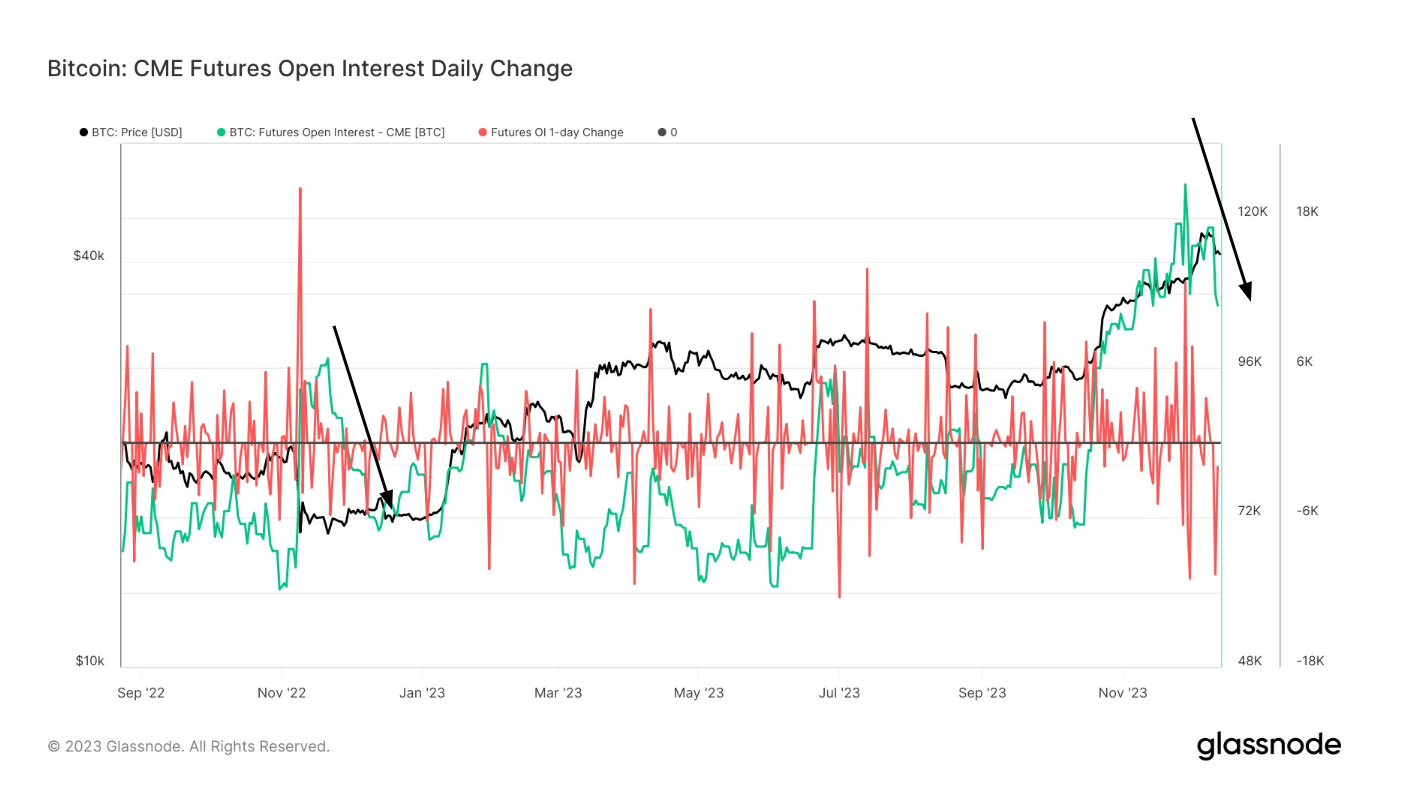

From mid-October, the Chicago Mercantile Exchange (CME) has maintained its position as the premier exchange for Bitcoin futures, augmenting its Open Interest by approximately 45,000 BTC through the end of November. However, this shift was marked by approximately 20,000 Bitcoin contracts being closed from CME since Nov. 28. In a notable downturn…

Expanding on the Topic

As the year-end approaches, the Chicago Mercantile Exchange’s Bitcoin futures Open Interest has seen a significant decline. This decrease in Open Interest suggests that market sentiment towards Bitcoin futures may be waning as investors potentially look to close out their positions before the end of the year. The reduction in Open Interest could signal a shift in investor behavior or uncertainty in the cryptocurrency market.

Despite the decline in Open Interest, the Chicago Mercantile Exchange remains a key player in the cryptocurrency futures market. Its strong position as a regulated and reputable exchange continues to attract traders and investors looking to gain exposure to Bitcoin through futures contracts.

How Will This Affect Me?

For individual investors or traders involved in Bitcoin futures on the Chicago Mercantile Exchange, the falling Open Interest may signal a changing market dynamic. It could impact trading strategies and decision-making, as lower Open Interest may lead to increased volatility or less liquidity in the market. It’s essential for traders to stay informed and adapt to changing market conditions to mitigate risks and capitalize on opportunities.

How Will This Affect the World?

The decline in Bitcoin futures Open Interest at the Chicago Mercantile Exchange could have broader implications for the cryptocurrency market and global financial markets. A decrease in Open Interest may reflect shifting sentiment towards Bitcoin and cryptocurrency assets, impacting overall market trends and investor confidence. It could also influence regulatory attitudes towards cryptocurrency derivatives and shape future market developments.

Conclusion

As the Chicago Mercantile Exchange’s Bitcoin futures Open Interest falls heading into the year-end, the cryptocurrency market faces potential challenges and opportunities. Traders and investors must monitor market trends closely and adapt their strategies accordingly to navigate the evolving landscape of cryptocurrency futures trading.