Unlocking the Potential of Micron Stock

The Rollercoaster Ride of Micron Stock

Since its latest earnings report, Micron stock has been on a rollercoaster ride, swinging wildly in response to market conditions. The company’s performance has been a subject of much speculation, with analysts closely watching key indicators such as DRAM demand and NAND oversupply.

Strength in DRAM Demand

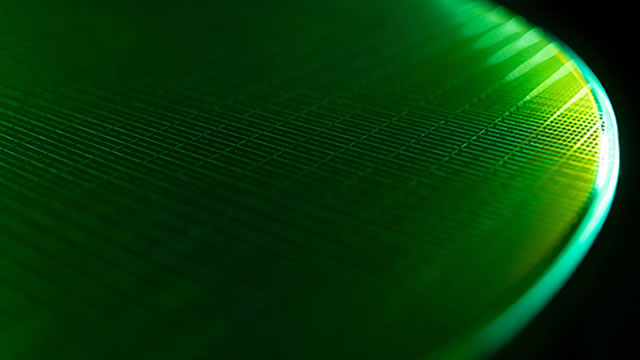

One of the bright spots for Micron is the strong demand for DRAM chips. As technology continues to advance, the need for memory and storage solutions has only increased. Micron has positioned itself well in this market, capitalizing on the growing demand for DRAM chips in various devices and applications.

Clearing NAND Oversupply

On the flip side, Micron has been facing challenges with NAND oversupply. This has put pressure on prices and affected the company’s bottom line. However, there are signs that the oversupply may be poised to clear, which could provide a much-needed boost to Micron’s operating results.

The Potential for a Major Recovery

Looking ahead, some analysts are optimistic about Micron’s potential for a major recovery in its operating results. With DRAM demand remaining strong and the possibility of NAND oversupply clearing, Micron could see significant improvements in its performance in Q4 and the second half of calendar year 2025.

How Micron’s Performance Will Affect You

Personal Impact

As a potential investor, the performance of Micron stock could have a direct impact on your investment portfolio. A major recovery in operating results could lead to increased stock prices, providing you with potential gains. On the other hand, if Micron continues to face challenges, it could result in losses for investors.

How Micron’s Performance Will Affect the World

Global Impact

Micron is a key player in the semiconductor industry, providing memory and storage solutions that are essential for a wide range of devices and applications. A major recovery in Micron’s operating results could have a ripple effect on the global technology market, driving innovation and advancement in various industries.

Conclusion

In conclusion, the future of Micron stock is full of potential and possibility. With strong DRAM demand and signs of NAND oversupply clearing, Micron could be on the brink of a major recovery. As an investor, it’s important to closely monitor Micron’s performance and consider the potential impact on your investment portfolio. And on a larger scale, the performance of Micron could have far-reaching effects on the global technology market, driving innovation and shaping the future of the industry.