The Airbnb Dilemma: Why I Sold My Shares

Introduction

Since the IPO of Airbnb, I have been a strong believer in the company’s potential. With its strong network effects, lean capital structure, and ability to generate free cash flow, I saw Airbnb as a solid investment opportunity. However, despite Airbnb’s impressive Q4 earnings and promising first 2025 outlook, I recently made the decision to sell my shares. In this article, I will delve into the reasons behind my decision.

Reasons for Selling

While Airbnb’s Q4 earnings were indeed impressive, with revenue exceeding expectations and a strong growth trajectory, there are certain factors that led me to believe that it was time to part ways with the company’s stock.

1. Competitive Landscape

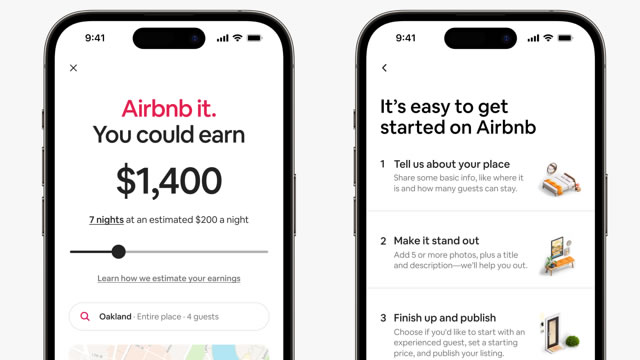

The short-term rental market is becoming increasingly competitive, with new players entering the space and existing competitors ramping up their offerings. This increased competition could potentially impact Airbnb’s market share and pricing power in the long run.

2. Regulatory Risks

Airbnb has faced regulatory challenges in various markets, with local governments implementing restrictions on short-term rentals. These regulatory risks could have a significant impact on Airbnb’s operations and profitability in the future.

3. Valuation Concerns

Despite Airbnb’s strong performance, the company’s valuation has been pushed to high levels, raising concerns about its sustainability in the long term. As an investor, I am wary of investing in companies that are trading at overly inflated valuations.

Impact on Me

As an investor who sold my shares in Airbnb, this decision may have short-term implications on my portfolio performance. However, I believe that by diversifying my investments and reallocating capital to potentially more promising opportunities, I can mitigate any potential downsides.

Impact on the World

With investors like myself selling off their shares in Airbnb, the market may see a shift in sentiment towards the company. This could potentially impact Airbnb’s stock price and future funding opportunities, as investors reassess the company’s growth prospects and competitive positioning in the market.

Conclusion

In conclusion, while I was initially bullish on Airbnb, I have decided to sell my shares due to concerns about the increasing competition, regulatory risks, and valuation levels. While this decision may have short-term implications for my portfolio, I believe it is a necessary step to safeguard my long-term investment goals. Moving forward, I will continue to monitor the market closely and seek out investment opportunities that align more closely with my risk tolerance and investment criteria.