Applied Materials Stock Drops After Fiscal Q1 2025 Results

Overview

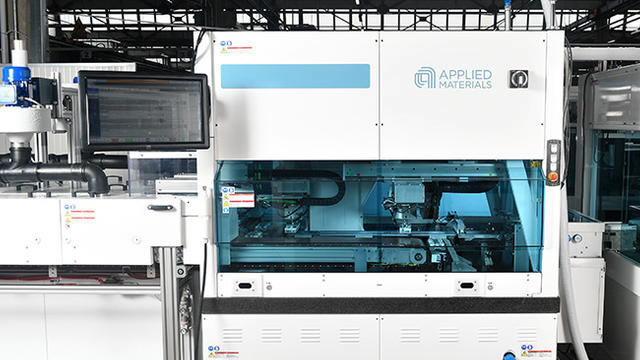

Shares of semiconductor company Applied Materials (AMAT -7.26%) pulled back on Friday after the company reported financial results for its fiscal first quarter of 2025. As of 2:15 p.m., Applied Materials stock was down 7.26% from the previous day’s close.

Analysis

The drop in Applied Materials stock price comes after the company reported mixed financial results for the quarter. While revenue beat analysts’ expectations, earnings fell short of estimates. Additionally, the company issued cautious guidance for the upcoming quarter, citing macroeconomic uncertainties and supply chain challenges.

Investors reacted negatively to the news, selling off shares of Applied Materials and causing the stock price to decline. The semiconductor industry as a whole has been facing challenges in recent months, including chip shortages, geopolitical tensions, and rising production costs.

Impact on Investors

For investors holding Applied Materials stock, the drop in price may lead to losses in their portfolio. It is important for investors to carefully consider their investment strategy and risk tolerance in light of the company’s latest financial results and outlook.

Impact on the Semiconductor Industry

The decline in Applied Materials stock price could indicate broader concerns within the semiconductor industry. As a leading supplier of equipment and services to chip manufacturers, Applied Materials’ performance is closely watched as a barometer of the industry’s health.

Conclusion

Overall, the pullback in Applied Materials stock following the fiscal Q1 2025 results highlights the challenges facing the semiconductor industry in the current economic environment. Investors and industry stakeholders will be closely monitoring developments in the coming months to gauge the sector’s resilience and potential for growth.