Welcome to the Wacky World of O’Reilly Automotive Stocks!

Why I Have Some Reservations About ORLY

Alright, buckle up folks, because we’re about to take a wild ride into the world of O’Reilly Automotive stocks. Now, don’t get me wrong, I’m not saying that ORLY is a bad investment. In fact, their recent 4Q24 results showed some pretty solid performance with 4.4% comps growth and a whopping $4.1 billion in revenue. That’s nothing to sneeze at, right?

But here’s the thing – despite these strong fundamentals, I just can’t shake the feeling that ORLY is a bit, well, overvalued. I mean, trading at 29.5x forward earnings? That’s a pretty hefty price tag if you ask me. And let’s not forget that their EPS missed consensus recently thanks to a one-time charge. Ouch.

The Road Ahead for ORLY

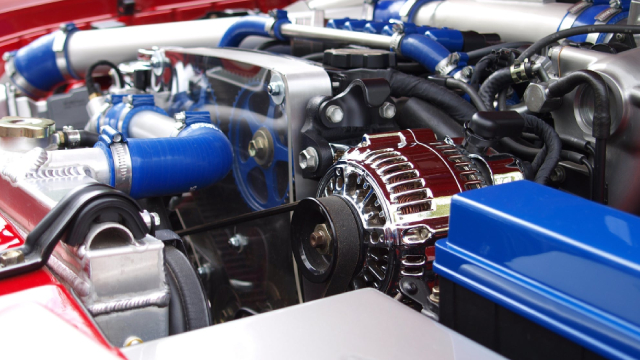

Now, I’m not here to rain on anyone’s parade. I’m just a simple blogger trying to make sense of this crazy world we live in. And when it comes to ORLY, I do see some potential roadblocks ahead. Sure, industry tailwinds like the increasing complexity of car repairs are definitely working in their favor. After all, who doesn’t need a good ol’ DIFM service every now and then?

But here’s the thing – while ORLY’s DIFM services are growing faster than their DIY sales, I can’t help but wonder if they can keep up this pace. Will customers continue to flock to their doors in droves, or will they start looking for greener pastures elsewhere?

How ORLY’s Valuation Could Affect You

Now, let’s talk turkey – how is this whole ORLY situation going to affect you, dear reader? Well, if you’re already invested in ORLY, you might want to keep a close eye on their valuation. With such a high price tag, there’s always the risk of a pullback in the stock price, and nobody wants to see their hard-earned money go up in smoke.

On the other hand, if you’re thinking about jumping on the ORLY bandwagon, you might want to proceed with caution. While they certainly have some strong fundamentals, that expensive valuation could come back to bite you in the long run. As always, do your homework and make sure you’re comfortable with the risks before diving in headfirst.

The Global Impact of ORLY’s Performance

Alright, let’s zoom out for a minute and take a look at the bigger picture. How will ORLY’s performance affect the world at large? Well, for starters, a strong showing from ORLY could be a sign of good things to come for the automotive industry as a whole.

After all, if a major player like ORLY is raking in the profits, it could mean that consumers are feeling more confident about spending money on car repairs and maintenance. And in a world where the economy is teetering on the edge of a recession, that’s definitely a ray of sunshine peeking through the clouds.

In Conclusion…

So there you have it, folks – my two cents on the wild and wacky world of O’Reilly Automotive stocks. While ORLY certainly has some strong fundamentals working in their favor, that expensive valuation gives me pause. Will they be able to maintain this momentum in the long run, or will they hit a speed bump along the way?

Only time will tell, but one thing’s for sure – it’s never a dull moment when it comes to investing in the stock market!