Germany’s aggressive Bitcoin selling spree sparks heavy market turbulence

Quick Take

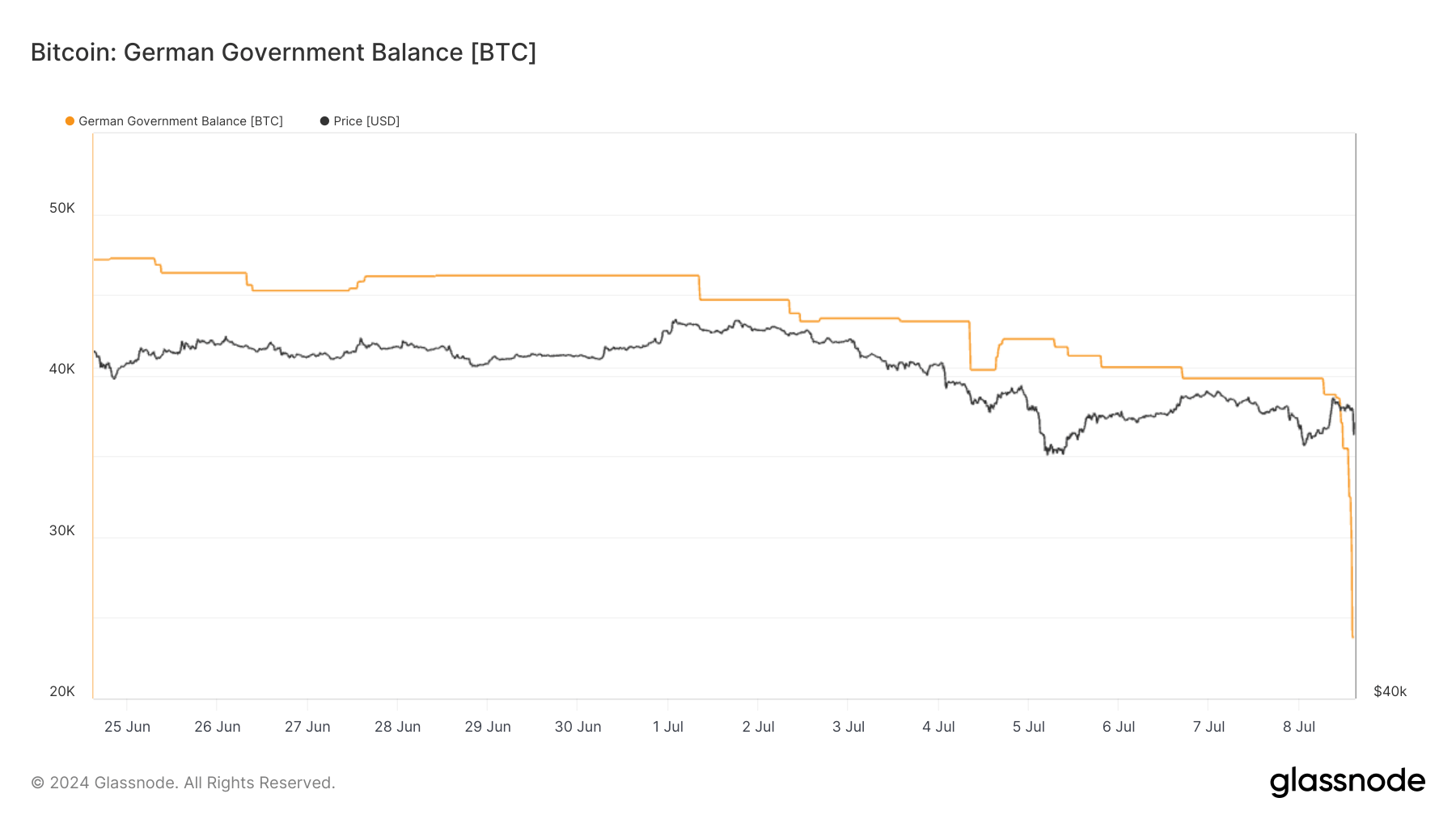

In the past 12 hours, Bitcoin’s price has experienced significant volatility, fluctuating between $54,400 and $58,200. This turbulence coincides with the German government’s ongoing sales of Bitcoin, a trend that has persisted for several weeks. As of July 8, the German government held approximately 23,788 Bitcoin, valued at $1.32 billion — less than 1% of the total supply. These consistent sell-offs have caused chaos in the market, leading to uncertainty and panic among investors.

Bitcoin, the world’s most popular cryptocurrency, has been facing extreme fluctuations in price as a result of Germany’s aggressive selling spree. The government’s decision to offload a significant portion of its Bitcoin holdings has had a profound impact on the market, causing prices to swing wildly within a short period. This sudden volatility has left investors on edge, unsure of what the future holds for the digital asset.

Many experts believe that Germany’s continuous selling of Bitcoin is a strategic move to diversify its investment portfolio and reduce its exposure to the volatile crypto market. By offloading such a large amount of Bitcoin, the German government is not only affecting the price of the cryptocurrency but also sending a signal to other market players about the risks associated with holding onto digital assets for an extended period.

Investors who have been closely monitoring the market have expressed concerns over the impact of Germany’s aggressive selling spree on their own portfolios. The sudden price fluctuations and market turmoil have triggered a wave of panic selling, leading to further downward pressure on Bitcoin’s price. Many are now questioning whether Bitcoin can recover from this sell-off and regain its momentum in the near future.

How will this affect me?

As an investor in cryptocurrencies, Germany’s aggressive Bitcoin selling spree is likely to have a direct impact on your portfolio. The increased volatility and uncertainty in the market could lead to significant losses if you are not prepared to weather the storm. It is essential to closely monitor the market trends and adjust your investment strategy accordingly to mitigate potential risks.

How will this affect the world?

Germany’s relentless selling of Bitcoin is not just a local phenomenon but has implications for the global cryptocurrency market as a whole. The constant sell-offs by the German government are creating ripples in the market, causing prices to fluctuate wildly and triggering panic among investors worldwide. This situation highlights the interconnected nature of the cryptocurrency market and the impact that a single player can have on its overall stability.

Conclusion

In conclusion, Germany’s aggressive Bitcoin selling spree has sparked heavy market turbulence, leading to chaos and uncertainty among investors. The continuous sell-offs by the German government have caused significant fluctuations in Bitcoin’s price, prompting widespread panic selling and creating a ripple effect in the global cryptocurrency market. It is essential for investors to remain vigilant and adapt their investment strategy to navigate through these challenging times.