BTC Upside Remain Capped Amid Headline Macro Risk and Inflation Concerns

Introduction

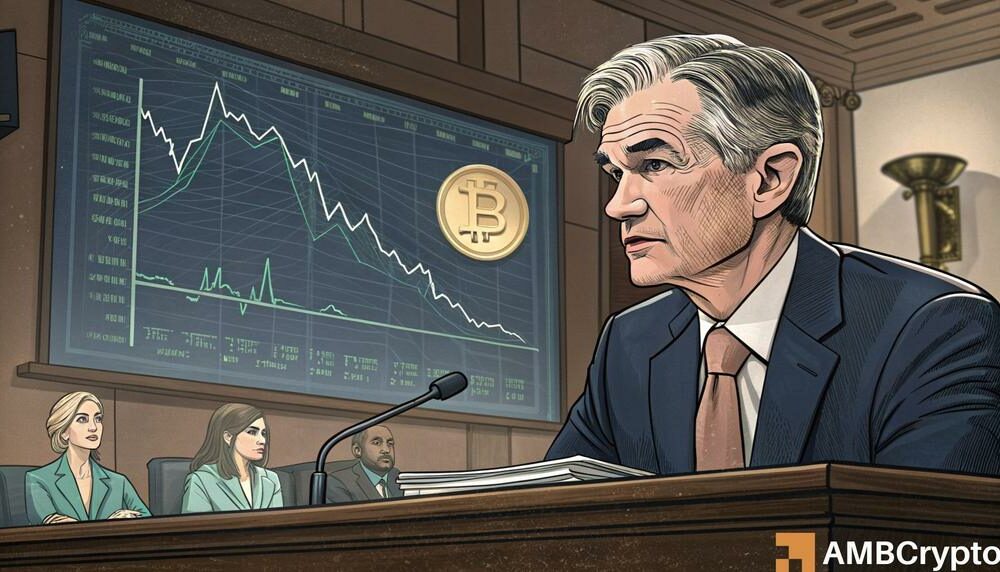

Bitcoin, the world’s largest cryptocurrency, has been facing challenges as its upside remains capped amid headline macro risk and inflation concerns. The cryptocurrency market has been volatile, with Bitcoin struggling to break past key resistance levels.

Macro Risk

One of the factors limiting Bitcoin’s upside potential is headline macro risk. Uncertainty in global markets, geopolitical tensions, and economic instability can negatively impact the price of Bitcoin. Investors tend to flock to traditional safe-haven assets like gold during times of uncertainty, which can hinder Bitcoin’s price growth.

Inflation Concerns

Another challenge facing Bitcoin is inflation concerns. With central banks around the world pumping money into the economy to stimulate growth, there are worries about inflation eroding the value of fiat currencies. While Bitcoin is often touted as a hedge against inflation, its price can still be influenced by inflationary pressures.

Impact on Individuals

For individual investors, the capped upside potential of Bitcoin means that they may need to exercise caution when trading or investing in the cryptocurrency. It is important to stay informed about macroeconomic events and inflation trends that could affect the price of Bitcoin. Diversifying your investment portfolio beyond cryptocurrencies can help mitigate risk.

Impact on the World

As Bitcoin remains capped amid macro risk and inflation concerns, the cryptocurrency market as a whole may experience increased volatility. This could have ripple effects on global financial markets and investor sentiment. Regulators and policymakers may also continue to closely monitor the cryptocurrency market in light of these challenges.

Conclusion

In conclusion, Bitcoin’s upside potential remains constrained by headline macro risk and inflation concerns. Individual investors should be wary of these challenges and stay informed about factors that could impact the price of Bitcoin. The cryptocurrency market’s stability and future growth will continue to be influenced by macroeconomic events and inflationary pressures.