QuickLogic Stock Update

QuickLogic (QUIK) Closed at $7.31

QuickLogic (QUIK) reached $7.31 at the closing of the latest trading day, reflecting a -0.95% change compared to its last close. This slight decrease in stock price has caught the attention of investors and analysts alike, leading to speculation about the future performance of the company.

Market Analysis

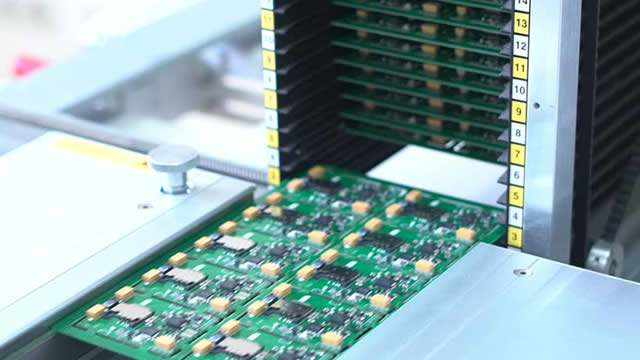

Despite the recent dip in stock price, QuickLogic has shown strong growth potential in the past. The company specializes in low-power semiconductor solutions, which are in high demand in today’s technology-driven world. With the increasing focus on energy efficiency and portable devices, QuickLogic’s products are well-positioned to capture a larger market share in the coming years.

Investors who believe in the long-term prospects of QuickLogic may see this temporary price drop as a buying opportunity. By purchasing stock at a lower price, investors can potentially benefit from future price appreciation as the company continues to grow and expand its product offerings.

Impact on Investors

For investors holding QuickLogic stock, the decrease in price may be concerning. However, it’s important to remember that fluctuations in the stock market are common and not necessarily indicative of a company’s underlying performance. It’s essential to conduct thorough research and analysis before making any investment decisions based on short-term price movements.

How This Affects Me

As a potential investor, the dip in QuickLogic’s stock price may pique my interest in the company. By conducting further research and analysis, I can determine whether this presents a buying opportunity or a signal to exercise caution in investing in QuickLogic.

Global Impact

On a larger scale, the performance of companies like QuickLogic can have broader implications for the global economy. As technology continues to play a significant role in driving innovation and growth, the success of semiconductor companies could contribute to advancements in various industries, from electronics to renewable energy.

Conclusion

In conclusion, the recent price decrease in QuickLogic stock may be a cause for concern for some investors, but it also presents an opportunity for potential buyers to enter the market at a lower price point. By carefully evaluating the company’s performance and growth prospects, investors can make informed decisions about their investments in QuickLogic.