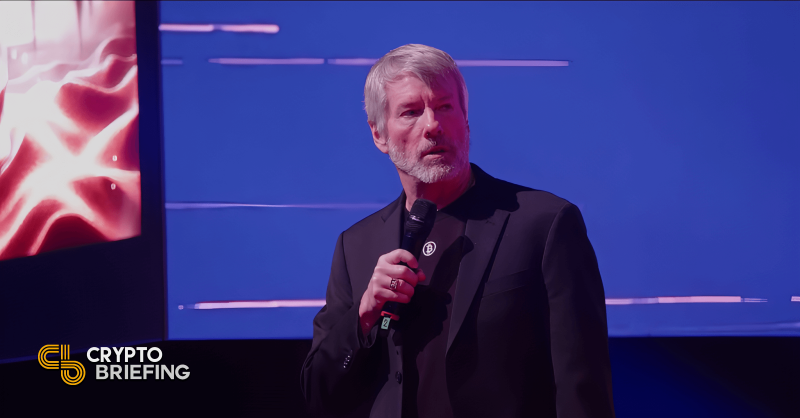

Michael Saylor’s Aggressive Bitcoin Acquisition Strategy

Saylor acquires 7,633 Bitcoin after one-week break

Holdings now worth $46B

Michael Saylor, the CEO of MicroStrategy, is making waves in the world of cryptocurrency with his aggressive Bitcoin acquisition strategy. In a recent move, Saylor acquired 7,633 Bitcoin after a one-week break, bringing his total holdings to a value of $46 billion.

Saylor’s strategic approach to acquiring Bitcoin could have significant implications for market dynamics and corporate treasury management trends. By accumulating such a large amount of Bitcoin, Saylor is not only increasing his own wealth but also influencing the overall market.

Bitcoin has been gaining momentum as a mainstream investment option, with many companies and individuals looking to add it to their portfolio. Saylor’s actions are a clear indication of the growing acceptance and adoption of Bitcoin as a legitimate asset class.

With his substantial holdings, Saylor has the power to sway market prices and influence the decisions of other corporate treasuries. His bold moves have caught the attention of the cryptocurrency community and are sure to have a lasting impact on the industry.

Overall, Michael Saylor’s aggressive Bitcoin acquisition strategy is a testament to the potential of cryptocurrency as a viable investment option. His actions are reshaping the landscape of corporate finance and are likely to set new trends in the world of treasury management.

How this will affect me:

As an individual investor, Michael Saylor’s aggressive Bitcoin acquisition strategy could potentially impact the price of Bitcoin in the short term. If Saylor continues to buy large amounts of Bitcoin, it could lead to increased volatility in the market. However, in the long run, his actions may contribute to the mainstream acceptance of Bitcoin as a legitimate investment option.

How this will affect the world:

Michael Saylor’s strategy of acquiring a large amount of Bitcoin could have far-reaching effects on the world of corporate finance. His actions are a clear indication of the growing interest in cryptocurrency as an asset class, and may encourage other companies to follow suit. This shift towards digital assets could reshape traditional financial systems and pave the way for a more decentralized economy.

Conclusion:

In conclusion, Michael Saylor’s aggressive Bitcoin acquisition strategy is a bold move that is sure to have a lasting impact on the cryptocurrency industry. His actions are not only increasing his own wealth but also influencing market dynamics and corporate treasury management trends. As Bitcoin continues to gain mainstream acceptance, Saylor’s strategy may set new standards for investment in the digital age.