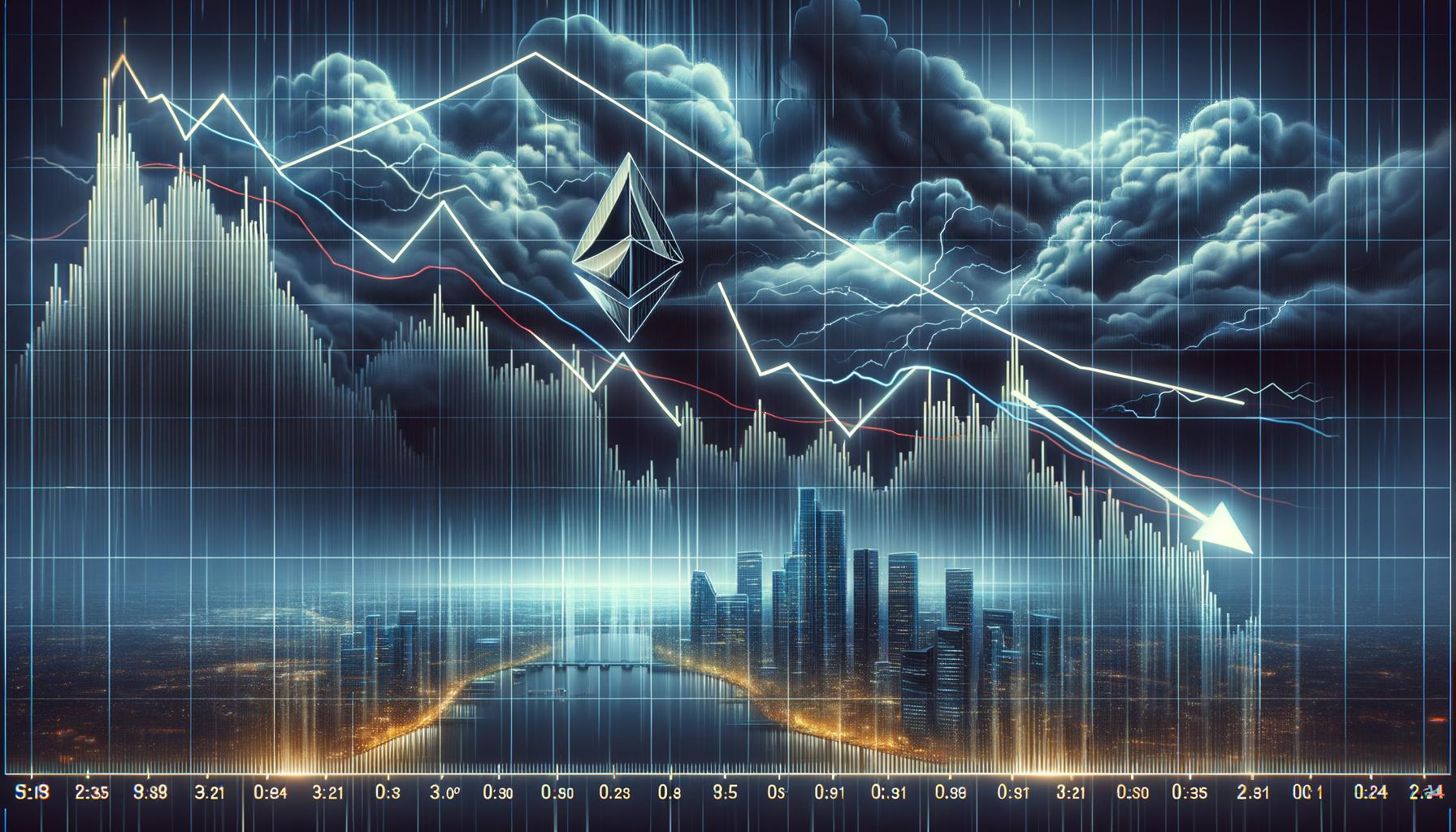

Ethereum’s Increased Short Positions and Market Volatility

The Impact on Investor Confidence

Ethereum’s recent surge in short positions has been causing a stir in the cryptocurrency community. As short positions reach record highs, many investors are becoming nervous about the potential impact on Ethereum’s price and overall market volatility.

When short positions increase, it typically means that investors are betting on the price of Ethereum to decrease. This can create a self-fulfilling prophecy as more investors start to sell off their holdings, leading to a domino effect of price drops.

Market-Wide Effects

The heightened volatility in Ethereum’s price could have ripple effects throughout the entire cryptocurrency market. As one of the top cryptocurrencies by market capitalization, Ethereum’s movements are closely watched by investors and traders alike. If Ethereum’s price experiences a significant drop due to the increase in short positions, it could trigger a sell-off in other major cryptocurrencies as well.

The post Ethereum’s price under pressure as short positions reach record highs from Crypto Briefing highlights the growing concern over Ethereum’s current market dynamics. Investors are urged to proceed with caution and closely monitor their positions as the situation continues to unfold.

Effects on Individuals

For individual investors, the increased short positions in Ethereum could mean heightened uncertainty and potential losses in their investment portfolios. It is crucial for investors to stay informed and consider their risk tolerance when making decisions in such a volatile market environment.

Global Impact

As one of the leading cryptocurrencies, Ethereum’s price movements can have a significant impact on the global cryptocurrency market. Any major fluctuations in Ethereum’s price could lead to increased market instability and affect the confidence of investors worldwide. It is essential for both individual and institutional investors to closely monitor the situation and adapt their strategies accordingly.

Conclusion

In conclusion, Ethereum’s increased short positions have the potential to create heightened volatility in the cryptocurrency market, impacting investor confidence and triggering market-wide effects. As the situation continues to unfold, it is important for investors to stay informed, exercise caution, and adapt their strategies to navigate through these uncertain times.