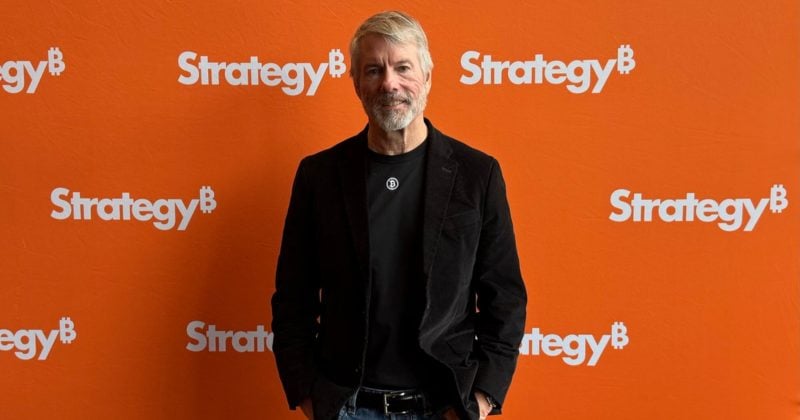

Strategy’s Continued Bitcoin Investments: Michael Saylor’s Influence

What Happened?

Strategy’s continued Bitcoin investments amid market volatility could influence corporate treasury strategies and crypto market dynamics. The post Michael Saylor hints at Strategy’s upcoming Bitcoin purchase amid price fluctuations appeared first on Crypto Briefing. This strategic move by Strategy, led by Michael Saylor, highlights the ongoing trend of corporate entities adding Bitcoin to their balance sheets as a hedge against inflation and a store of value.

Michael Saylor’s Influence

Michael Saylor, the CEO of Strategy, has been a vocal advocate for Bitcoin as a long-term investment asset. His company’s decision to increase its Bitcoin holdings despite market fluctuations signals confidence in the cryptocurrency’s potential to serve as a reliable store of value. As more corporations follow Strategy’s lead and allocate a portion of their treasury reserves to Bitcoin, the crypto market dynamics could shift significantly.

How This Could Affect You

As more companies like Strategy invest in Bitcoin, there could be increased mainstream adoption of the cryptocurrency. This could lead to greater liquidity in the market and potentially drive up the price of Bitcoin. If you are already a holder of Bitcoin, this could mean an increase in the value of your investment. However, it is important to stay informed and monitor market trends to make informed decisions about buying, selling, or holding onto your Bitcoin.

How This Could Affect the World

The continued adoption of Bitcoin by corporate entities could have far-reaching implications for the global economy. As more companies diversify their treasury reserves with Bitcoin, traditional financial institutions may start to consider adding the cryptocurrency to their own portfolios. This could lead to increased legitimacy and acceptance of Bitcoin as a legitimate asset class, potentially paving the way for wider adoption and integration into mainstream financial systems.

Conclusion

In conclusion, Strategy’s ongoing Bitcoin investments, as hinted at by Michael Saylor, could have a significant impact on corporate treasury strategies and the broader crypto market. By demonstrating confidence in Bitcoin as a store of value, Strategy is setting a precedent for other companies to follow suit. Whether you are an individual investor or a global financial institution, staying informed about these developments and their potential implications is key to navigating the evolving landscape of cryptocurrency investments.