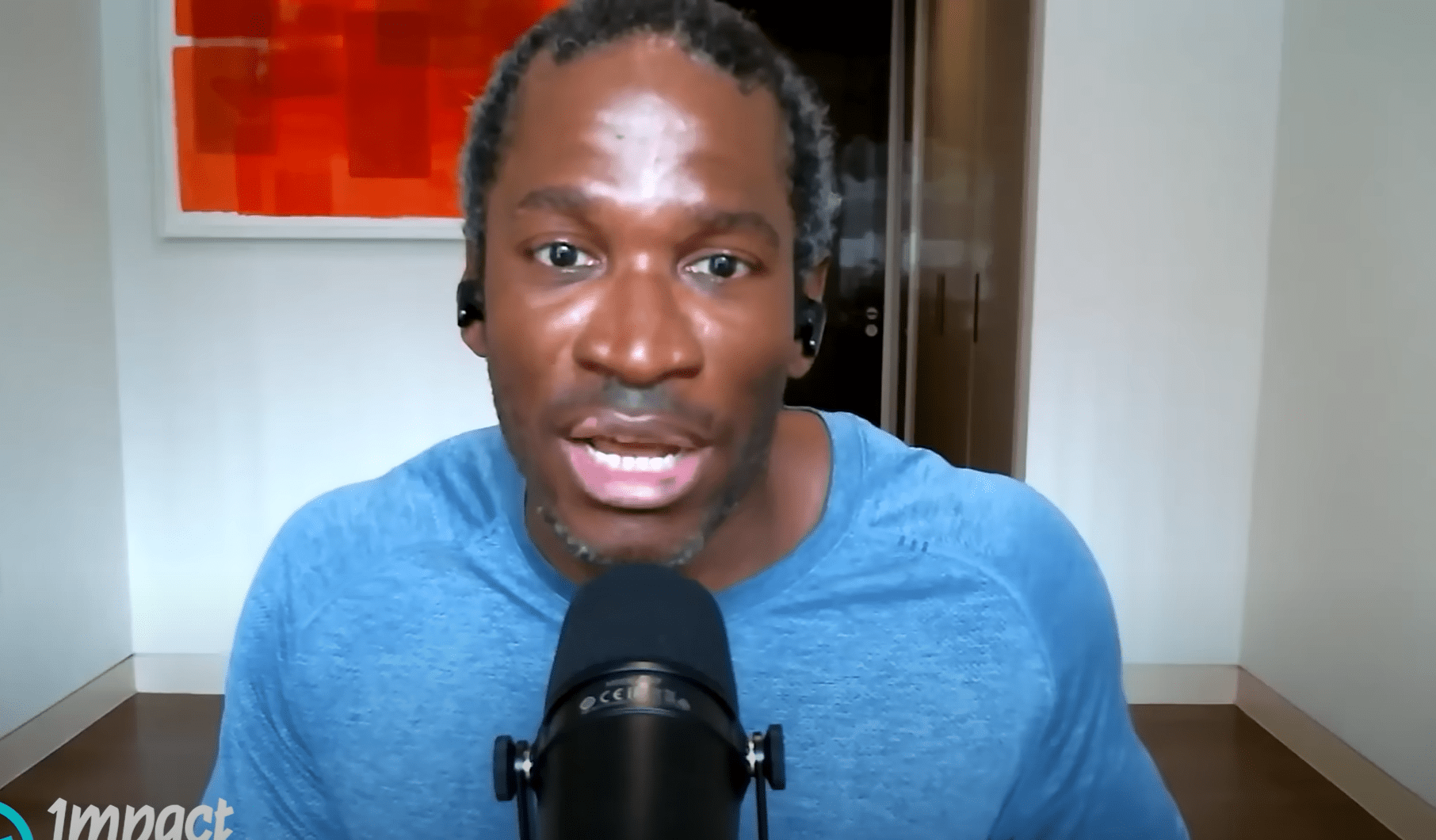

Arthur Hayes: The Genie

Introduction

In his latest essay entitled “The Genie,” crypto entrepreneur and former BitMEX CEO Arthur Hayes denounced calls for a United States Bitcoin Strategic Reserve (BSR), warning that such a program would create “unnecessary pain in under two years” and transform the world’s largest cryptocurrency into a potent political weapon. Hayes also cautioned the industry against pursuing what he deems to be an overcomplicated “Frankenstein crypto regulatory bill,” which, he argues, would primarily benefit large centralized institutions rather than foster true decentralization.

Expanding on the Topic

Hayes’ strong stance against the creation of a Bitcoin Strategic Reserve highlights his belief in the importance of maintaining the decentralized nature of cryptocurrencies. He argues that establishing such a reserve would only lead to government interference and manipulation, ultimately undermining the principles on which Bitcoin was founded.

Furthermore, Hayes’ criticism of a potential crypto regulatory bill sheds light on the challenges faced by the industry in finding a balance between regulation and decentralization. While some may argue that regulation is necessary to protect investors and ensure market stability, Hayes warns against the dangers of overregulation that could stifle innovation and favor large institutions over individual users.

Impact on Individuals

For individual crypto investors and enthusiasts, Hayes’ essay serves as a wake-up call to the potential risks associated with government intervention in the cryptocurrency space. If a Bitcoin Strategic Reserve were to be established, it could lead to increased volatility and uncertainty, making it more difficult for individuals to navigate the market effectively.

Similarly, the prospect of a complex regulatory bill could limit the opportunities for small players in the industry, favoring established institutions with the resources to comply with stringent regulations. This could potentially stifle innovation and restrict access to decentralized financial services for ordinary users.

Impact on the World

On a global scale, Hayes’ warnings about the implications of a Bitcoin Strategic Reserve and an overly complex regulatory framework highlight the potential implications for financial markets and geopolitical dynamics. The transformation of Bitcoin into a political weapon could have far-reaching consequences, impacting not only the cryptocurrency industry but also global economic stability.

Furthermore, a regulatory framework that favors centralized institutions over decentralization could hinder the growth of the crypto industry as a whole, limiting the potential for disruptive technologies to drive innovation and empower individuals worldwide.

Conclusion

Arthur Hayes’ essay “The Genie” serves as a thought-provoking critique of current proposals for a Bitcoin Strategic Reserve and complex regulatory legislation. His insights into the potential risks and implications of these initiatives underscore the importance of preserving the decentralized nature of cryptocurrencies and fostering a more inclusive and innovative industry. As individuals and as a global community, it is crucial that we heed Hayes’ warnings and advocate for a balanced approach to regulation that promotes decentralization and protects the interests of all participants in the cryptocurrency ecosystem.