“Bitcoin’s Wild Ride: Tips from ‘Rich Dad, Poor Dad’ Author to Boost Your Wealth Game”

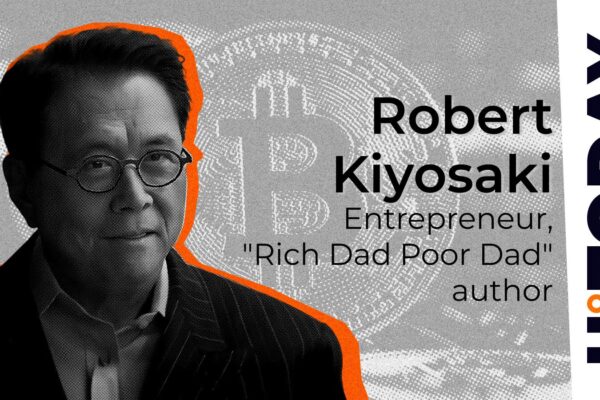

Robert Kiyosaki’s Bitcoin Warning: A Silver Lining for Investors The Warning Robert Kiyosaki, the financial guru best known for his book “Rich Dad Poor Dad” and his popular YouTube podcasts, has recently issued a stark warning about Bitcoin. In a recent interview, he cautioned investors about the volatility and uncertainty surrounding the popular cryptocurrency. Kiyosaki…